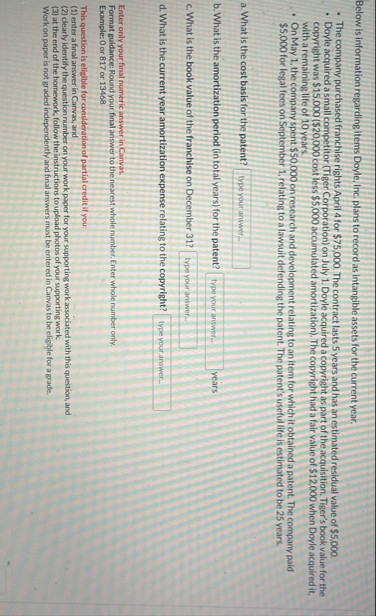

Question: Below is information regarding items Doyle, Inc. plans to record as intangible assets for the current year. The company purchased franchise rights April 4 for

Below is information regarding items Doyle, Inc. plans to record as intangible assets for the current year.

The company purchased franchise rights April for $ The contract lasts years and has an estimated residual value of $

Doyle acquired a small competitor Tiger Corporation on July Doyle acquired a copyright as part of the acquisition. Tiger's book value for the copyright was $ $ cost less $ accumulated amortization The copyright had a fair value of $ when Doyle acquired it with a remaining life of years.

On May the company spent $ on research and development relating to an item for which it obtained a patent. The company paid $ for legal fees on September relating to a lawsuit defending the patent. The patent's useful life is estimated to be years.

a What is the cost basis for the patent?

b What is the amortization period in total years for the patent? years

c What is the book value of the franchise on December

d What is the current year amortization expense relating to the copyright?

Enter only your final numeric answer in Canyas.

Format guidance: Round your final answer to the nearest whole number, Enter whole number only.

Example: or or

This question is eligible for consideration of partial credit if you:

enter a final answer in Canvas, and

clearly identify the question number on your work poper for your supporting work associated with this question, and

at the end of the homework, follow the instructions to upload photos of your supporting work

Work on paper is not graded independently and final arswers must be entered in Carvas to be eligible for a grade.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock