Question: Below is screenshots with questions. Also attached is online source in order to answer question 1. Please answer all fully and let me know if

Below is screenshots with questions. Also attached is online source in order to answer question 1. Please answer all fully and let me know if you have any questions.

https://treasurydirect.gov/indiv/indiv.htm

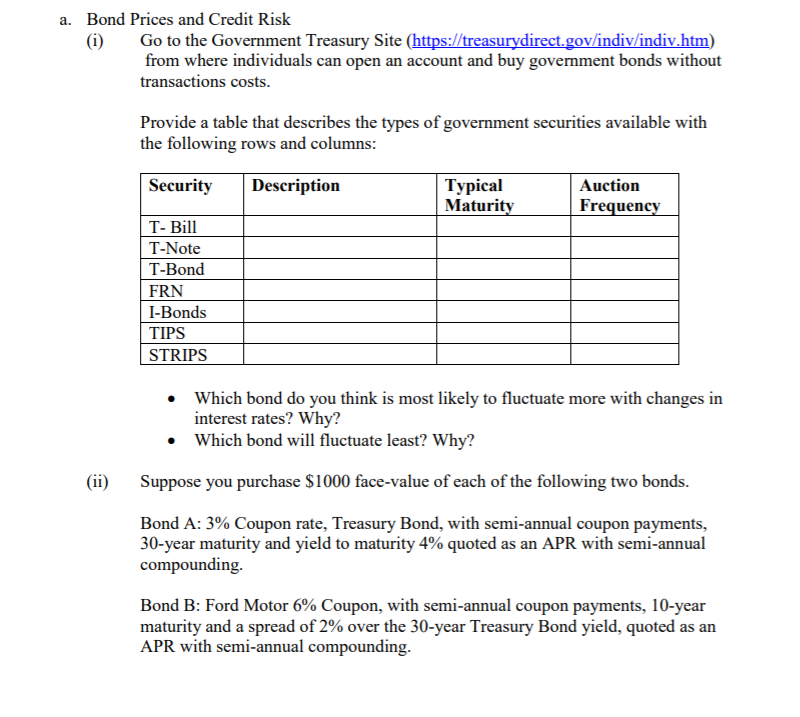

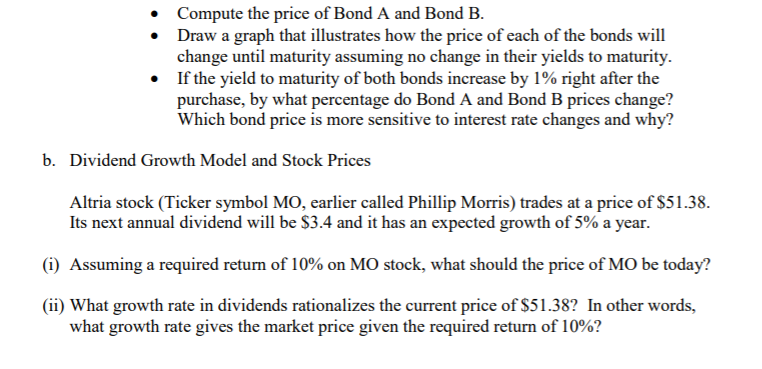

a. Bond Prices and Credit Risk (i) (ii) Go to the Government Treasury Site (https://treasurydirect.gov/indiv/indiv.htm) from where individuals can open an account and buy government bonds without transactions costs. Provide a table that describes the types of government securities available with the following rows and columns: Description Security T- Bill T-Note T-Bond FRN I-Bonds TIPS STRIPS Typical Maturity Auction Frequency Which bond do you think is most likely to fluctuate more with changes in interest rates? Why? Which bond will fluctuate least? Why? Suppose you purchase $1000 face-value of each of the following two bonds. Bond A: 3% Coupon rate, Treasury Bond, with semi-annual coupon payments, 30-year maturity and yield to maturity 4% quoted as an APR with semi-annual compounding. Bond B: Ford Motor 6% Coupon, with semi-annual coupon payments, 10-year maturity and a spread of 2% over the 30-year Treasury Bond yield, quoted as an APR with semi-annual compounding.

Step by Step Solution

There are 3 Steps involved in it

Here is a table describing the types of government securities available on the TreasuryDirect website Security Description Typical Maturity Auction Frequency TBill Shortterm government debt with matur... View full answer

Get step-by-step solutions from verified subject matter experts