Question: Below is select information for the current year for P and S companies. P owns 100% of S. There are no intercompany transactions or adjustments

Below is select information for the current year for P and S companies. P owns 100% of S. There are no intercompany transactions or adjustments required as a result of the acquisition.

- P's shareholders can convert the bonds to 2,000 shares of common stock. The annual interest (net of tax) that P pays on the bonds is $4,200.

- Compute

- 1) Diluted EPS as it would appear on the consolidated income statement for the current year.

2) What is the numerator in your computation?

3) What is the denominator in your computation?

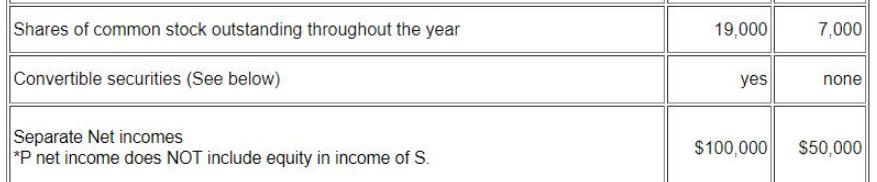

Shares of common stock outstanding throughout the year Convertible securities (See below) Separate Net incomes *P net income does NOT include equity in income of S. 19,000 yes 7,000 none $100,000 $50,000

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

answer 1 To compute the diluted earnings per share EPS as it would appear on the consolidated income ... View full answer

Get step-by-step solutions from verified subject matter experts