Question: Below is some actual data for call options on Amazon (AMZN) from June 14, 2019. The options expire on July 19, 2019. AMZNs most recent

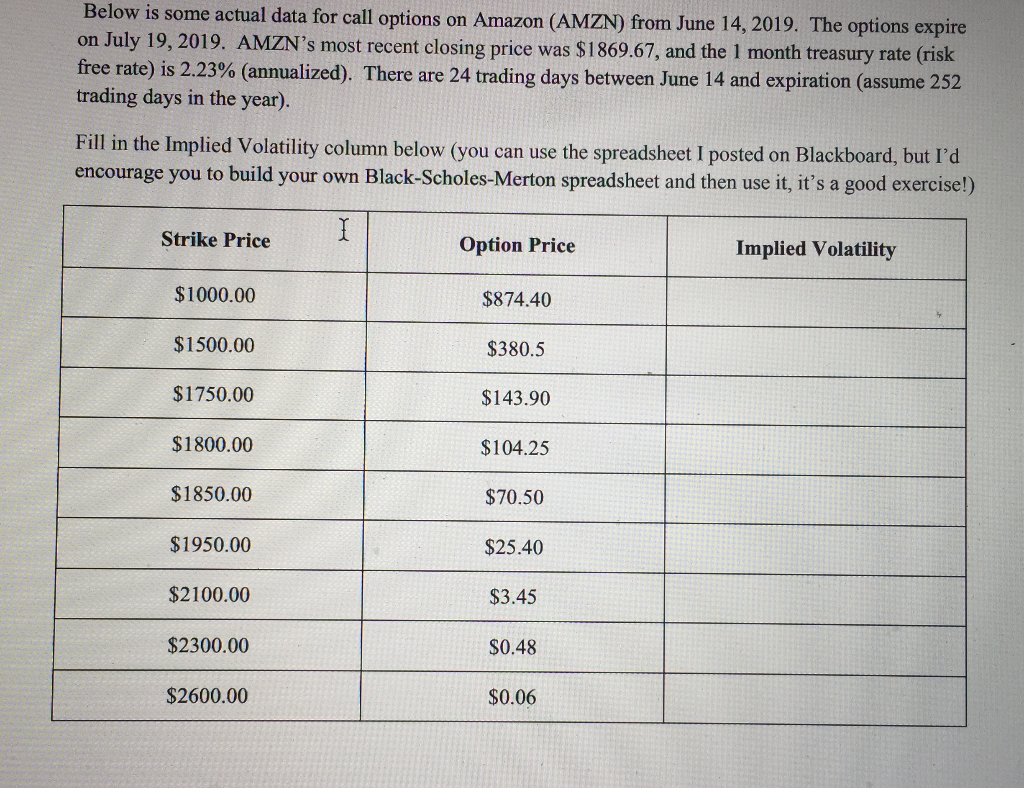

Below is some actual data for call options on Amazon (AMZN) from June 14, 2019. The options expire on July 19, 2019. AMZNs most recent closing price was $1869.67, and the 1 month treasury rate (risk free rate) is 2.23% (annualized). There are 24 trading days between June 14 and expiration (assume 252 trading days in the year).

Fill in the Implied Volatility column below (you can use the spreadsheet I posted on Blackboard, but Id encourage you to build your own Black-Scholes-Merton spreadsheet and then use it, its a good exercise!)

Below is some actual data for call options on Amazon (AMZN) from June 14, 2019. The options expire on July 19, 2019. AMZN's most recent closing price was $1869.67, and the 1 month treasury rate (risk free rate) is 2.23 % ( annualized). There are 24 trading days between June 14 and expiration (assume 252 trading days in the year). Fill in the Implied Volatility column below (you can use the spreadsheet I posted on Blackboard, but I'd encourage you to build your own Black-Scholes-Merton spreadsheet and then use it, it's a good exercise!) Strike Price Option Price Implied Volatility $1000.00 $874.40 $1500.00 $380.5 $1750.00 $143.90 $1800.00 $104.25 $1850.00 $70.50 $1950.00 $25.40 $2100.00 $3.45 $2300.00 $0.48 $2600.00 $0.06 Below is some actual data for call options on Amazon (AMZN) from June 14, 2019. The options expire on July 19, 2019. AMZN's most recent closing price was $1869.67, and the 1 month treasury rate (risk free rate) is 2.23 % ( annualized). There are 24 trading days between June 14 and expiration (assume 252 trading days in the year). Fill in the Implied Volatility column below (you can use the spreadsheet I posted on Blackboard, but I'd encourage you to build your own Black-Scholes-Merton spreadsheet and then use it, it's a good exercise!) Strike Price Option Price Implied Volatility $1000.00 $874.40 $1500.00 $380.5 $1750.00 $143.90 $1800.00 $104.25 $1850.00 $70.50 $1950.00 $25.40 $2100.00 $3.45 $2300.00 $0.48 $2600.00 $0.06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts