Question: Below is some information about two options. Suppose you buy one call with a strike of EUR 45, buy one put with a strike of

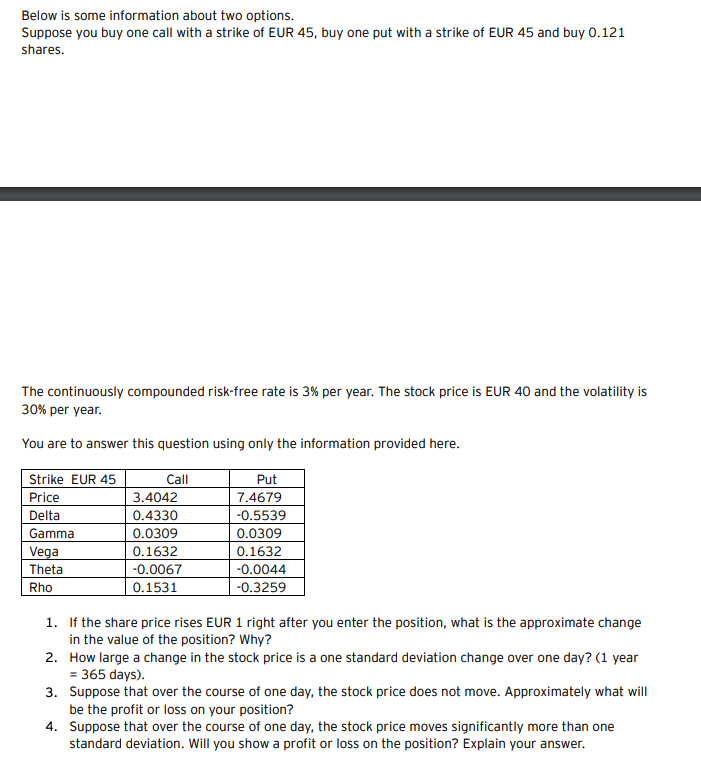

Below is some information about two options. Suppose you buy one call with a strike of EUR 45, buy one put with a strike of EUR 45 and buy 0.121 shares. The continuously compounded risk-free rate is 3% per year. The stock price is EUR 40 and the volatility is 30% per year You are to answer this question using only the information provided here Call Strike EUR 45 Price Delta Gamma 3.4042 0.4330 0.0309 0.1632 0.0067 0.1531 Put 7.4679 0.5539 0.0309 0.1632 0.0044 -0.3259 Theta Rho 1. If the share price rises EUR 1 right after you enter the position, what is the approximate change in the value of the position? Why? How large a change in the stock price is a one standard deviation change over one day? (1 year 2. 365 days) Suppose that over the course of one day, the stock price does not move. Approximately what will be the profit or loss on your position? Suppose that over the course of one day, the stock price moves significantly more than one standard deviation. Will you show a profit or loss on the position? Explain your answer. 3. 4. Below is some information about two options. Suppose you buy one call with a strike of EUR 45, buy one put with a strike of EUR 45 and buy 0.121 shares. The continuously compounded risk-free rate is 3% per year. The stock price is EUR 40 and the volatility is 30% per year You are to answer this question using only the information provided here Call Strike EUR 45 Price Delta Gamma 3.4042 0.4330 0.0309 0.1632 0.0067 0.1531 Put 7.4679 0.5539 0.0309 0.1632 0.0044 -0.3259 Theta Rho 1. If the share price rises EUR 1 right after you enter the position, what is the approximate change in the value of the position? Why? How large a change in the stock price is a one standard deviation change over one day? (1 year 2. 365 days) Suppose that over the course of one day, the stock price does not move. Approximately what will be the profit or loss on your position? Suppose that over the course of one day, the stock price moves significantly more than one standard deviation. Will you show a profit or loss on the position? Explain your answer. 3. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts