Question: Below is the additional information for abc Question 3: Activity-Based Costing (35 Marks) Super Shoe company makes two types of shoes-the Runner and the Comforter.

Below is the additional information for abc

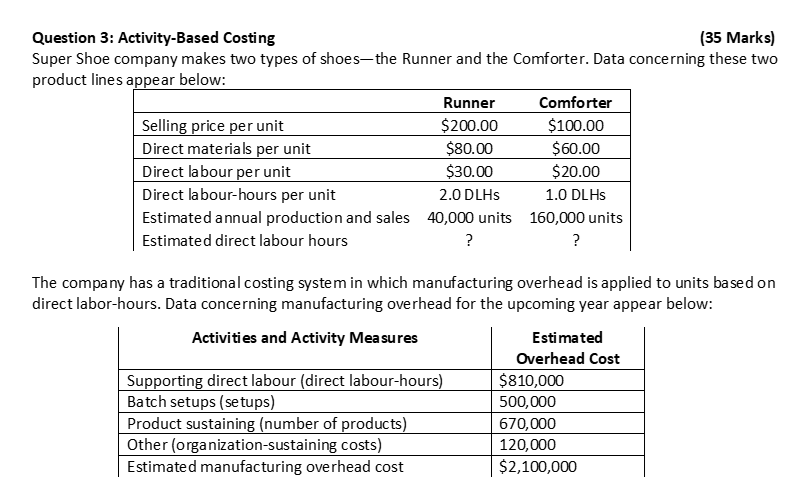

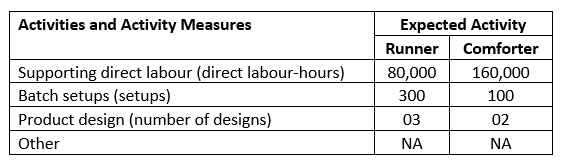

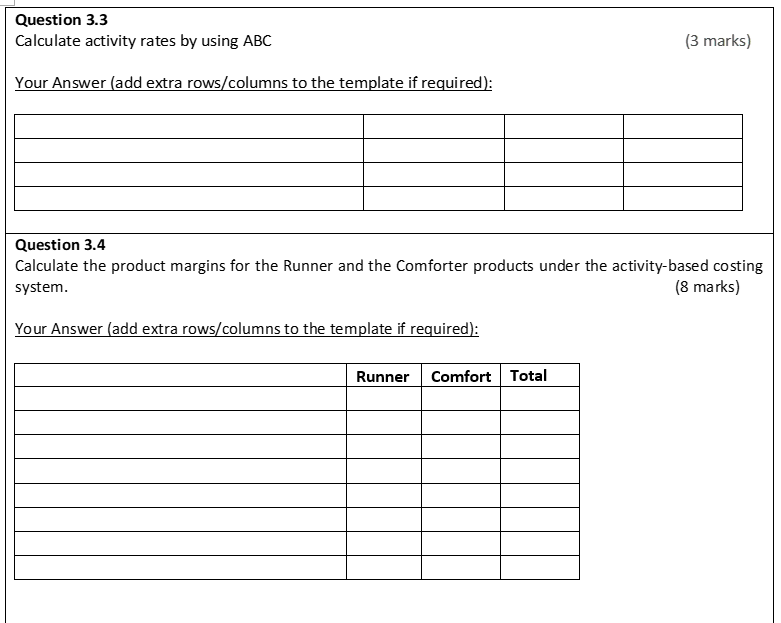

Question 3: Activity-Based Costing (35 Marks) Super Shoe company makes two types of shoes-the Runner and the Comforter. Data concerning these two product lines appear below: Runner Comforter Selling price per unit $200.00 $100.00 Direct materials per unit $80.00 $60.00 Direct labour per unit $30.00 $20.00 Direct labour-hours per unit 2.0 DLHs 1.0 DLHS Estimated annual production and sales 40,000 units 160,000 units Estimated direct labour hours ? ? The company has a traditional costing system in which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead for the upcoming year appear below: Activities and Activity Measures Estimated Overhead Cost Supporting direct labour (direct labour-hours) $810,000 Batch setups (setups) 500,000 Product sustaining (number of products) 670,000 Other (organization-sustaining costs) 120,000 Estimated manufacturing overhead cost $2,100,000 Activities and Activity Measures Supporting direct labour (direct labour-hours) Batch setups (setups) Product design (number of designs) Other Expected Activity Runner Comforter 80,000 160,000 300 100 03 02 NA NA Question 3.3 Calculate activity rates by using ABC (3 marks) Your Answer (add extra rows/columns to the template if required): Question 3.4 Calculate the product margins for the Runner and the Comforter products under the activity-based costing system. (8 marks) Your Answer (add extra rows/columns to the template if required): Runner Comfort Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts