Question: Below is the answer for question a) I cannot understand how to get sales from Janitron Plz explain where did 396, 605, 813, 1812,

Below is the answer for question a)

I cannot understand how to get sales from Janitron

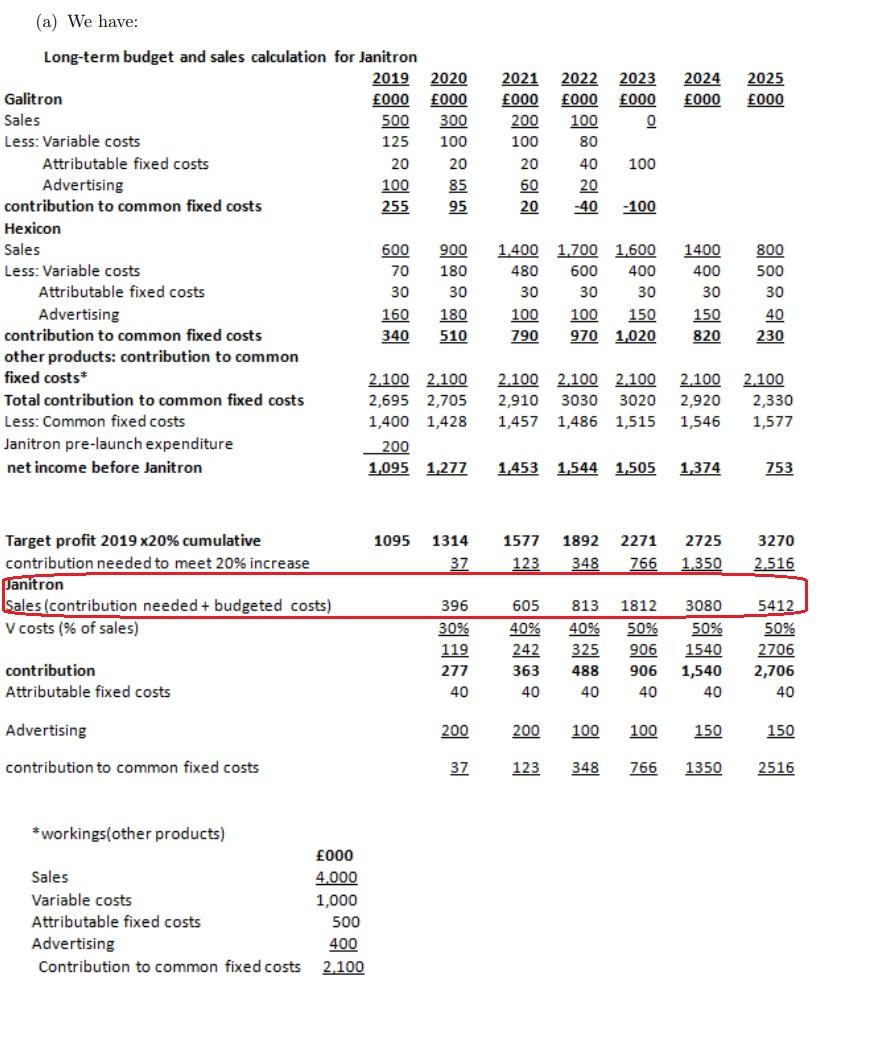

Plz explain where did " 396, 605, 813, 1812, 3080, 5412" come from!

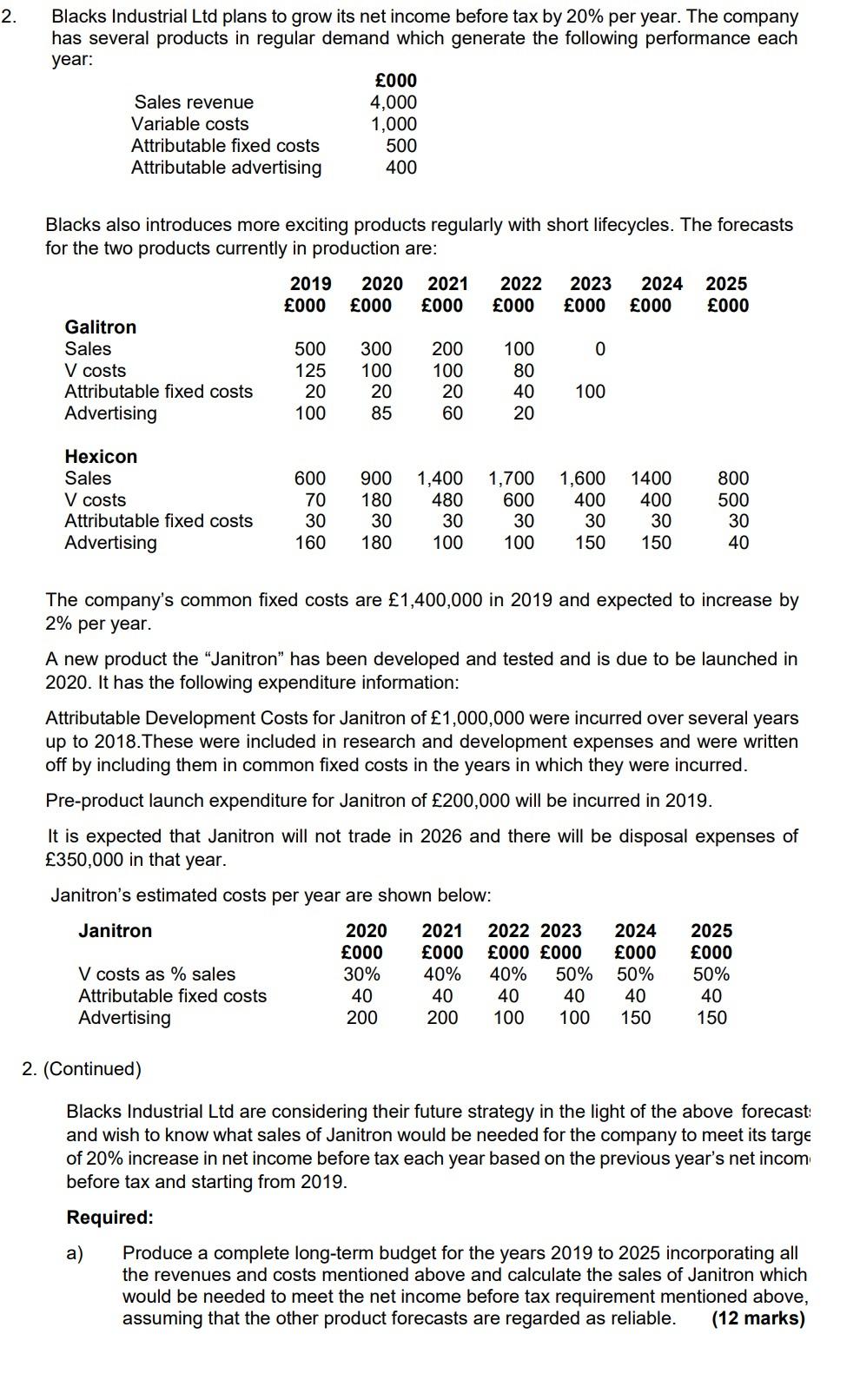

2. Blacks Industrial Ltd plans to grow its net income before tax by 20% per year. The company has several products in regular demand which generate the following performance each year: 000 Sales revenue Variable costs 1,000 Attributable fixed costs 500 Attributable advertising 400 4,000 Blacks also introduces more exciting products regularly with short lifecycles. The forecasts for the two products currently in production are: 2019 2020 2021 2022 2023 2024 2025 000 000 000 000 000 000 000 Galitron Sales 500 300 200 100 0 V costs 125 100 100 80 Attributable fixed costs 20 20 20 40 100 Advertising 100 85 60 20 Hexicon Sales V costs Attributable fixed costs Advertising 600 70 30 160 900 180 30 180 1,400 480 30 100 1,700 600 30 100 1,600 400 30 150 1400 400 30 150 800 500 30 40 The company's common fixed costs are 1,400,000 in 2019 and expected to increase by 2% per year. A new product the "Janitron has been developed and tested and is due to be launched in 2020. It has the following expenditure information: Attributable Development Costs for Janitron of 1,000,000 were incurred over several years up to 2018. These were included in research and development expenses and were written off by including them in common fixed costs in the years in which they were incurred. Pre-product launch expenditure for Janitron of 200,000 will be incurred in 2019. It is expected that Janitron will not trade in 2026 and there will be disposal expenses of 350,000 in that year. Janitron's estimated costs per year are shown below: Janitron 2025 V costs as % sales Attributable fixed costs Advertising 2020 000 30% 40 200 2021 000 40% 40 200 2022 2023 000 000 40% 50% 40 40 100 100 2024 000 50% 40 150 000 50% 40 150 2. (Continued) Blacks Industrial Ltd are considering their future strategy in the light of the above forecast: and wish to know what sales of Janitron would be needed for the company to meet its targe of 20% increase in net income before tax each year based on the previous year's net incom before tax and starting from 2019. Required: a) Produce a complete long-term budget for the years 2019 to 2025 incorporating all the revenues and costs mentioned above and calculate the sales of Janitron which would be needed to meet the net income before tax requirement mentioned above, assuming that the other product forecasts are regarded as reliable. (12 marks) (a) We have: 2023 000 0 2024 000 2025 000 500 2021 000 200 100 20 60 20 2022 000 100 80 40 20 -40 100 -100 Long-term budget and sales calculation for Janitron 2019 2020 Galitron 000 000 Sales 300 Less: Variable costs 125 100 Attributable fixed costs 20 20 Advertising 100 85 contribution to common fixed costs 255 95 Hexicon Sales 600 900 Less: Variable costs 70 180 Attributable fixed costs 30 30 Advertising 160 180 contribution to common fixed costs 340 510 other products: contribution to common fixed costs* 2.100 2.100 Total contribution to common fixed costs 2,695 2,705 Less: Common fixed costs 1,400 1,428 Janitron pre-launch expenditure 200 net income before Janitron 1,095 1,277 1,400 1,700 1,600 480 600 400 30 30 30 100 100 150 790 970 1,020 1400 400 30 150 820 800 500 30 40 230 2.100 2.100 2.100 2,910 3030 3020 1,457 1,486 1,515 2.100 2,920 1,546 2.100 2,330 1,577 1,453 1,544 1,505 1,374 753 1095 1892 1314 37 1577 123 2271 766 348 2725 1.350 3270 2.516 Target profit 2019 x20% cumulative contribution needed to meet 20% increase Panitron sales (contribution needed + budgeted costs) V costs (% of sales) 3080 396 30% 119 277 40 605 40% 242 363 40 813 40% 325 488 40 1812 50% 906 906 40 50% 1540 1,540 40 5412 50% 2706 2,706 40 contribution Attributable fixed costs Advertising 200 200 100 100 150 150 contribution to common fixed costs 37 123 348 766 1350 2516 *workings(other products) 000 Sales 4.000 Variable costs 1,000 Attributable fixed costs 500 Advertising 400 Contribution to common fixed costs 2.100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts