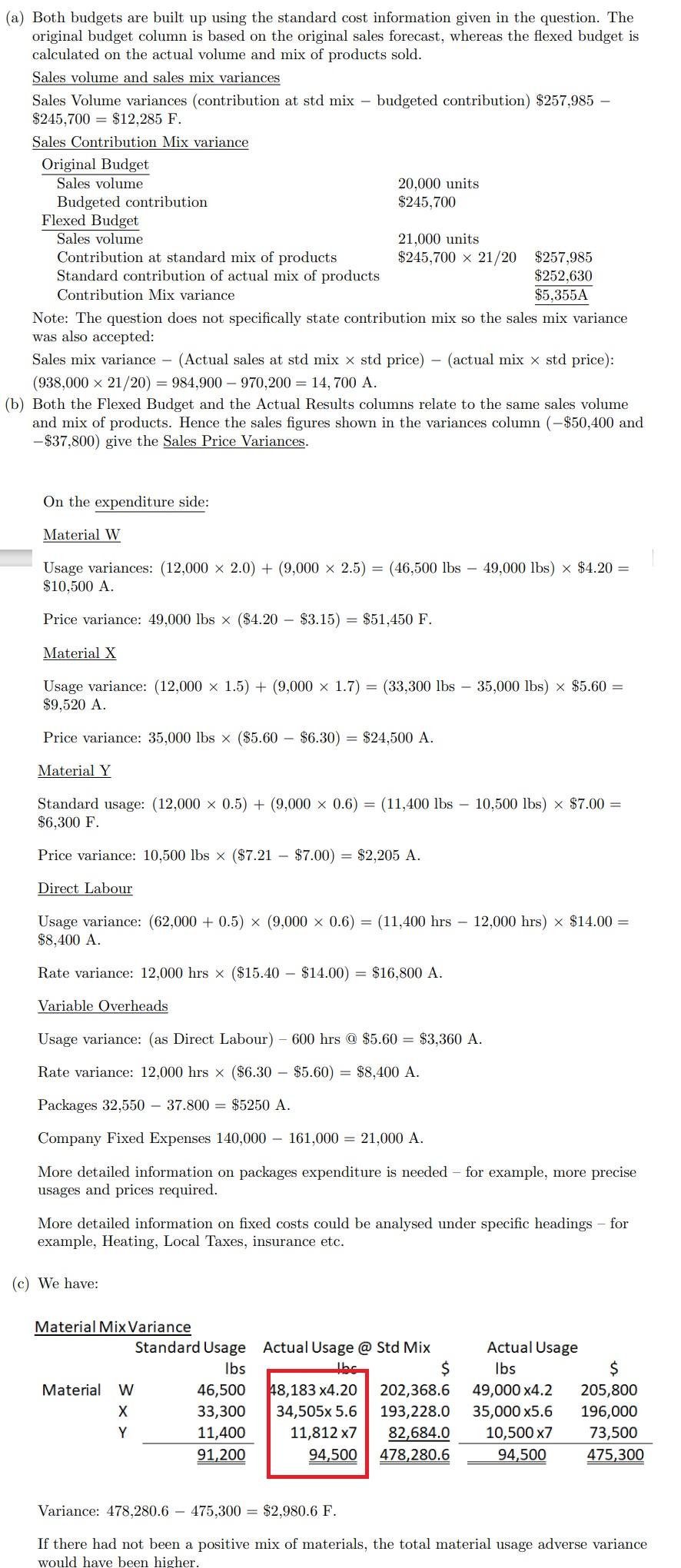

Question: Below is the answer for question a),b),c) please explan how to solve acual usage @std mix in c I don't understand where 48183, 34505, 11812

Below is the answer for question a),b),c)

please explan how to solve acual usage @std mix in c

I don't understand where 48183, 34505, 11812 comes from!

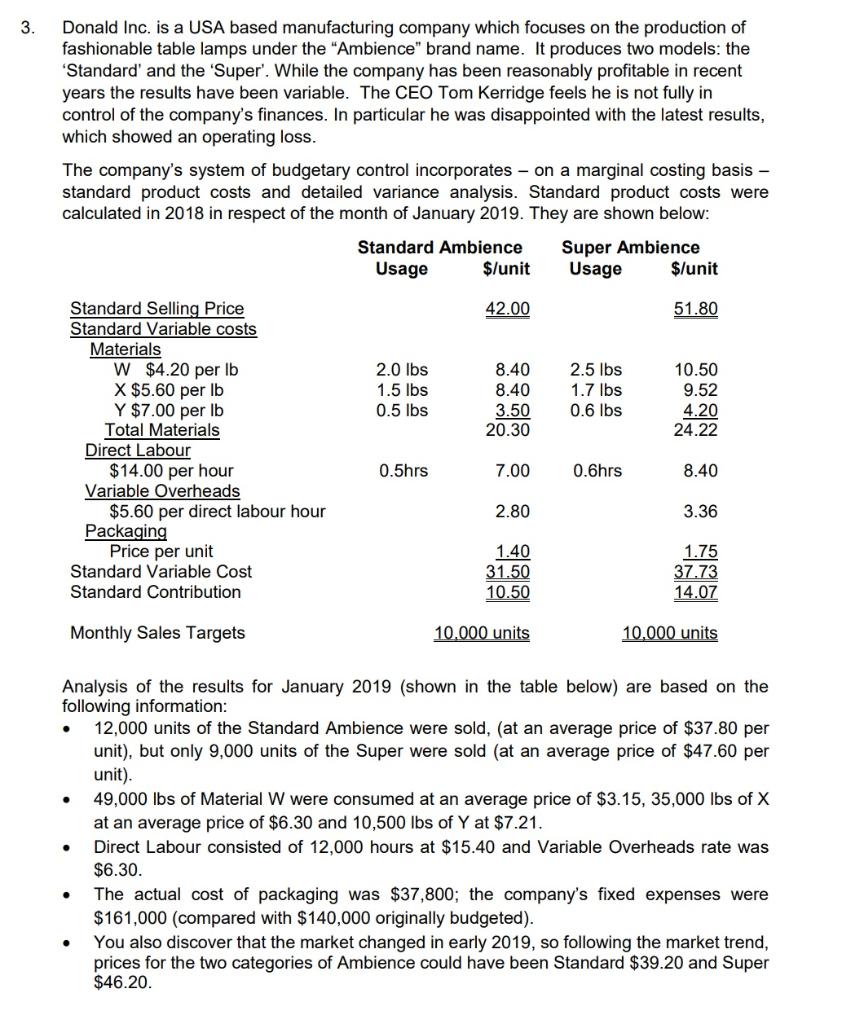

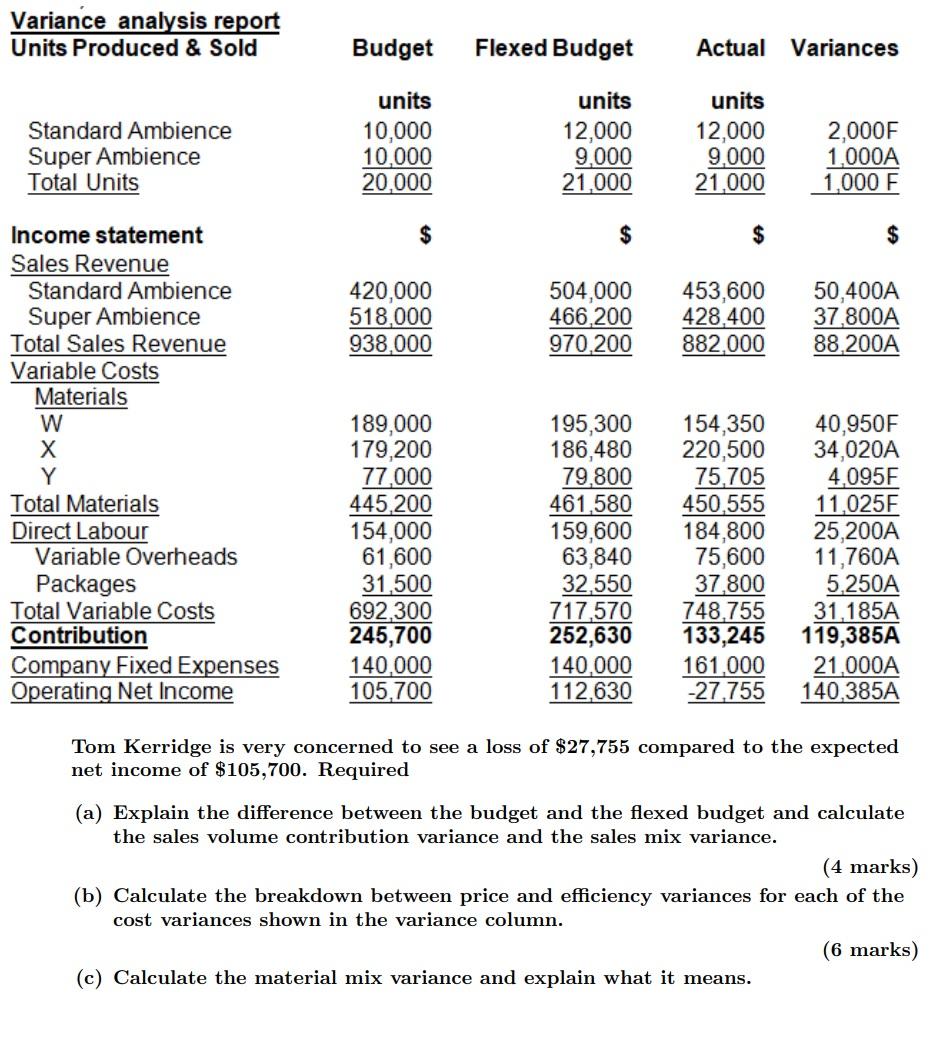

3. Donald Inc. is a USA based manufacturing company which focuses on the production of fashionable table lamps under the "Ambience" brand name. It produces two models: the 'Standard' and the 'Super'. While the company has been reasonably profitable in recent years the results have been variable. The CEO Tom Kerridge feels he is not fully in control of the company's finances. In particular he was disappointed with the latest results, which showed an operating loss. The company's system of budgetary control incorporates - on a marginal costing basis - standard product costs and detailed variance analysis. Standard product costs were calculated in 2018 in respect of the month of January 2019. They are shown below: Standard Ambience Super Ambience Usage $/unit Usage $/unit 42.00 51.80 2.0 lbs 1.5 lbs 0.5 lbs 8.40 8.40 3.50 20.30 2.5 lbs 1.7 lbs 0.6 lbs 10.50 9.52 4.20 24.22 Standard Selling Price Standard Variable costs Materials W $4.20 per lb X $5.60 per lb Y $7.00 per lb Total Materials Direct Labour $14.00 per hour Variable Overheads $5.60 per direct labour hour Packaging Price per unit Standard Variable Cost Standard Contribution 0.5hrs 7.00 0.6hrs 8.40 2.80 3.36 1.40 31.50 10.50 1.75 37.73 14.07 Monthly Sales Targets 10.000 units 10,000 units . . Analysis of the results for January 2019 (shown in the table below) are based on the following information: 12,000 units of the Standard Ambience were sold, (at an average price of $37.80 per unit), but only 9,000 units of the Super were sold (at an average price of $47.60 per unit). 49,000 lbs of Material W were consumed at an average price of $3.15, 35,000 lbs of X at an average price of $6.30 and 10,500 lbs of Y at $7.21. Direct Labour consisted of 12,000 hours at $15.40 and Variable Overheads rate was $6.30. The actual cost of packaging was $37,800; the company's fixed expenses were $161,000 (compared with $140,000 originally budgeted). You also discover that the market changed in early 2019, so following the market trend, prices for the two categories of Ambience could have been Standard $39.20 and Super $46.20. . Variance analysis report Units Produced & Sold Budget Flexed Budget Actual Variances Standard Ambience Super Ambience Total Units units 10,000 10,000 20,000 units 12,000 9,000 21,000 units 12,000 9,000 21,000 2,000F 1,000A 1,000 F $ $ 420,000 518,000 938,000 504,000 466,200 970.200 453,600 428,400 882.000 50,400A 37,800A 88,200A Income statement Sales Revenue Standard Ambience Super Ambience Total Sales Revenue Variable Costs Materials W Y Total Materials Direct Labour Variable Overheads Packages Total Variable Costs Contribution Company Fixed Expenses Operating Net Income 189,000 179,200 77,000 445,200 154,000 61,600 31,500 692,300 245,700 140,000 105,700 195,300 186,480 79,800 461,580 159,600 63,840 32,550 717,570 252,630 140,000 112,630 154,350 220,500 75,705 450,555 184,800 75,600 37,800 748,755 133,245 161,000 -27,755 40,950F 34,020A 4,095F 11,025F 25,200A 11,760A 5.250A 31,185A 119,385A 21,000A 140,385A Tom Kerridge is very concerned to see a loss of $27,755 compared to the expected net income of $105,700. Required (a) Explain the difference between the budget and the flexed budget and calculate the sales volume contribution variance and the sales mix variance. (4 marks) (b) Calculate the breakdown between price and efficiency variances for each of the cost variances shown in the variance column. (6 marks) (c) Calculate the material mix variance and explain what it means. (a) Both budgets are built up using the standard cost information given in the question. The original budget column is based on the original sales forecast, whereas the flexed budget is calculated on the actual volume and mix of products sold. Sales volume and sales mix variances Sales Volume variances (contribution at std mix - budgeted contribution) $257,985 $245,700 = $12,285 F. Sales Contribution Mix variance Original Budget Sales volume 20,000 units Budgeted contribution $245,700 Flexed Budget Sales volume 21,000 units Contribution at standard mix of products $245,700 x 21/20 $257,985 Standard contribution of actual mix of products $252,630 Contribution Mix variance $5,355A Note: The question does not specifically state contribution mix so the sales mix variance was also accepted: Sales mix variance - (Actual sales at std mix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts