Question: below is the answer for the question plz show me how to get numbers in the red box 2. Modern Manufacturing Ltd makes several products

below is the answer for the question

plz show me how to get numbers in the red box

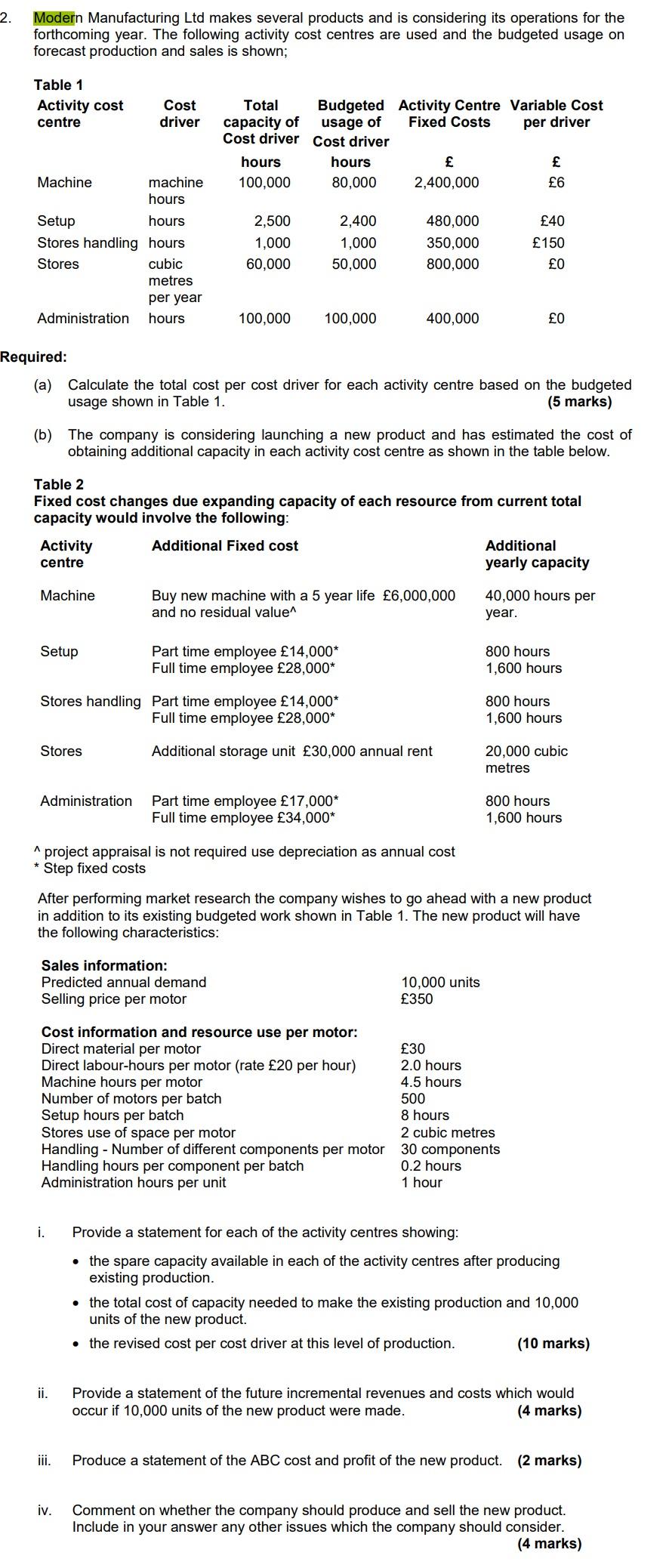

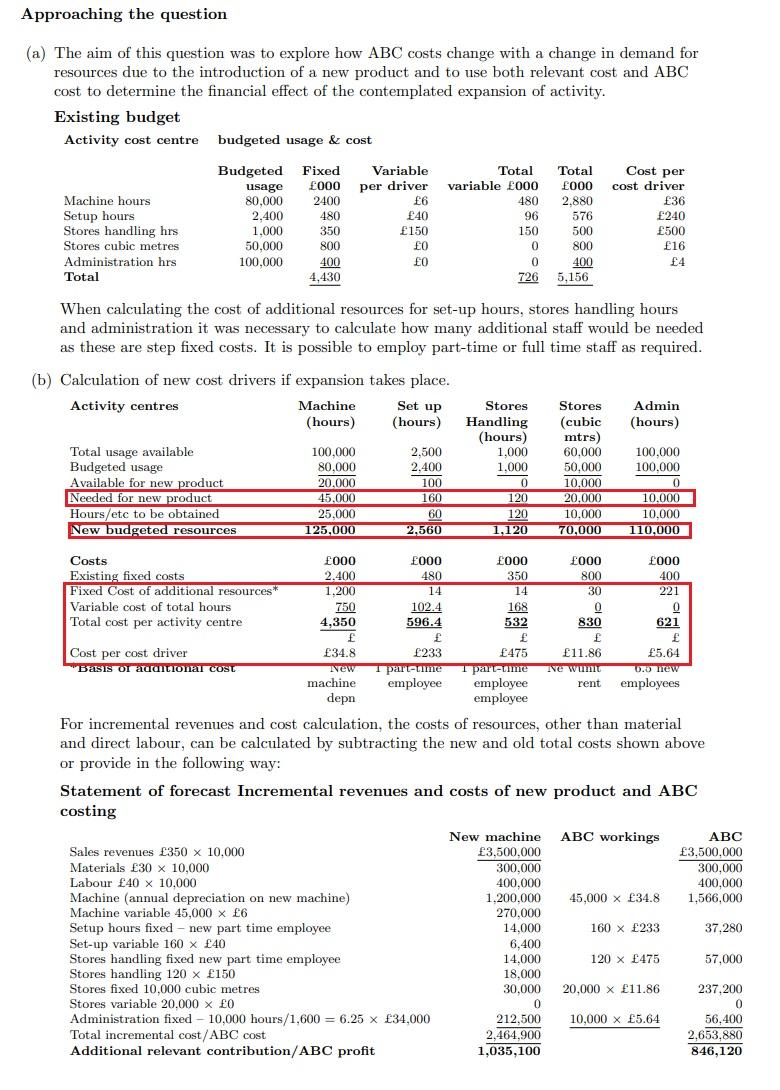

2. Modern Manufacturing Ltd makes several products and is considering its operations for the forthcoming year. The following activity cost centres are used and the budgeted usage on forecast production and sales is shown; Table 1 Activity cost centre Cost driver Total Budgeted Activity Centre Variable Cost capacity of usage of Fixed Costs per driver Cost driver Cost driver hours hours 100,000 80,000 2,400,000 6 40 Machine machine hours Setup hours Stores handling hours Stores cubic metres per year Administration hours 2,500 1,000 60,000 2,400 1,000 50,000 480,000 350,000 800,000 150 O 100,000 100,000 400,000 O Required: (a) Calculate the total cost per cost driver for each activity centre based on the budgeted usage shown in Table 1. (5 marks) (b) The company is considering launching a new product and has estimated the cost of obtaining additional capacity in each activity cost centre as shown in the table below. Table 2 Fixed cost changes due expanding capacity of each resource from current total capacity would involve the following: Activity Additional Fixed cost Additional centre yearly capacity Machine Buy new machine with a 5 year life 6,000,000 and no residual value 40,000 hours per year. Setup Part time employee 14,000* Full time employee 28,000* 800 hours 1,600 hours Stores handling Part time employee 14,000* Full time employee 28,000* 800 hours 1,600 hours Stores Additional storage unit 30,000 annual rent 20,000 cubic metres Administration Part time employee 17,000* Full time employee 34,000* 800 hours 1,600 hours ^ project appraisal is not required use depreciation as annual cost * Step fixed costs After performing market research the company wishes to go ahead with a new product in addition to its existing budgeted work shown in Table 1. The new product will have the following characteristics: Sales information: Predicted annual demand Selling price per motor 10,000 units 350 Cost information and resource use per motor: Direct material per motor 30 Direct labour-hours per motor (rate 20 per hour) 2.0 hours Machine hours per motor 4.5 hours Number of motors per batch 500 Setup hours per batch 8 hours Stores use of space per motor 2 cubic metres Handling - Number of different components per motor 30 components Handling hours per component per batch 0.2 hours Administration hours per unit 1 hour i. Provide a statement for each of the activity centres showing: the spare capacity available in each of the activity centres after producing existing production. the total cost of capacity needed to make the existing production and 10,000 units of the new product. the revised cost per cost driver at this level of production. (10 marks) ii. Provide a statement of the future incremental revenues and costs which would occur if 10,000 units of the new product were made. (4 marks) jii. Produce a statement of the ABC cost and profit of the new product. (2 marks) iv. Comment on whether the company should produce and sell the new product. Include in your answer any other issues which the company should consider. (4 marks) Approaching the question (a) The aim of this question was to explore how ABC costs change with a change in demand for resources due to the introduction of a new product and to use both relevant cost and ABC cost to determine the financial effect of the contemplated expansion of activity. Existing budget Activity cost centre budgeted usage & cost Cost per 480 4 4,430 Budgeted Fixed Variable Total Total usage 000 per driver variable 2000 000 cost driver Machine hours 80,000 2400 6 480 2.880 36 Setup hours 2.400 40 96 576 240 Stores handling hrs 1.000 350 150 150 500 500 Stores cubic metres 50,000 800 0 0 800 16 Administration hrs 100,000 400 0 0 400 Total 726 5,156 When calculating the cost of additional resources for set-up hours, stores handling hours and administration it was necessary to calculate how many additional staff would be needed as these are step fixed costs. It is possible to employ part-time or full time staff as required. (b) Calculation of new cost drivers if expansion takes place. Activity centres Machine Set up Stores Stores Admin (hours) (hours) Handling (cubic (hours) (hours) mtrs) Total usage available 100,000 2,500 1.000 60,000 100,000 Budgeted usage 80,000 2.400 1,000 50,000 100.000 Available for new product 20.000 100 0 10,000 0 Needed for new product 45,000 160 120 20,000 10.000 Hours/etc to be obtained 25.000 60 120 10.000 10.000 New budgeted resources 125,000 2,560 1,120 70,000 110,000 Costs 000 000 000 000 000 Existing fixed costs 2.400 480 350 800 400 Fixed Cost of additional resources 1.200 14 14 30 221 Variable cost of total hours 750 102.4 168 0 0 Total cost per activity centre 4,350 25 596.4 532 830 621 f Cost per cost driver 34.8 233 475 11.86 5.64 Basis or adattonat cost New 1 partume 1 parteme Ive wumu 6.3 new machine employee employee rent employees depn employee For incremental revenues and cost calculation, the costs of resources, other than material and direct labour, can be calculated by subtracting the new and old total costs shown above or provide in the following way: Statement of forecast Incremental revenues and costs of new product and ABC costing ABC 3,500,000 300,000 400,000 1,566.000 37.280 Sales revenues 350 X 10.000 Materials 30 X 10,000 Labour 40 x 10.000 Machine (annual depreciation on new machine) Machine variable 45,000 x 6 Setup hours fixed - new part time employee Set-up variable 160 x 40 Stores handling fixed new part time employee Stores handling 120 x 150 Stores fixed 10,000 cubic metres Stores variable 20.000 x 0 Administration fixed - 10,000 hours/1,600 = 6.25 x 34,000 Total incremental cost/ABC cost Additional relevant contribution/ABC profit New machine ABC workings 3,500,000 300,000 400.000 1,200,000 45.000 X 34.8 x 270.000 14,000 160 x 233 6,400 14.000 120 X 475 x 18.000 30,000 20,000 x 11.86 0 212.500 10,000 x 5.64 2,464,900 1,035,100 57.000 237.200 0 56.400 2.653,880 846,120

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts