Question: Below is the example from the book. Week 4: Group Assignment Chapter 17 discusses the Merton model. This is a variation on the Black-Scholes model

Below is the example from the book.

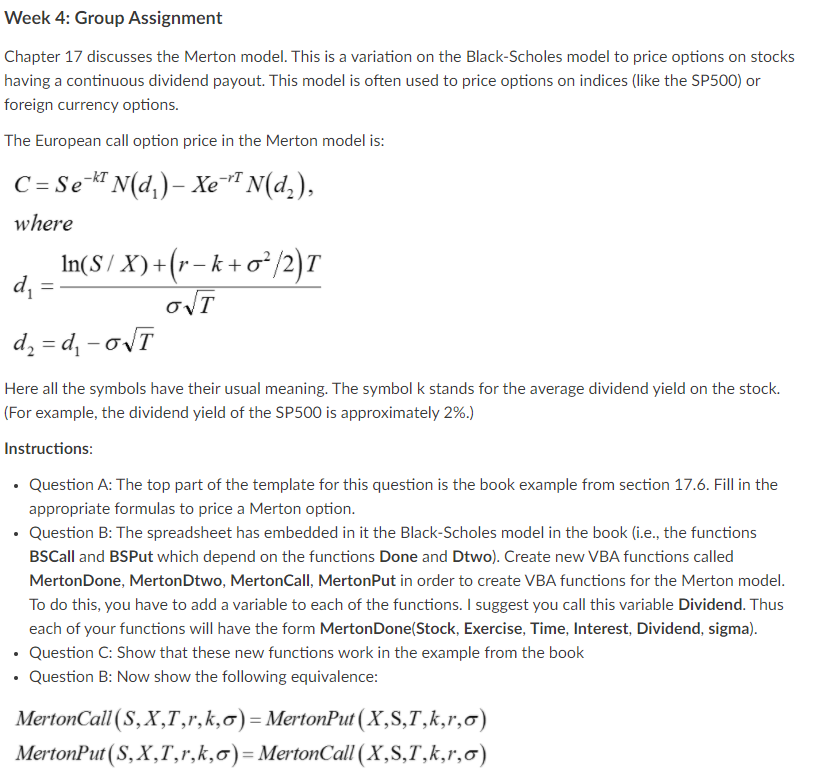

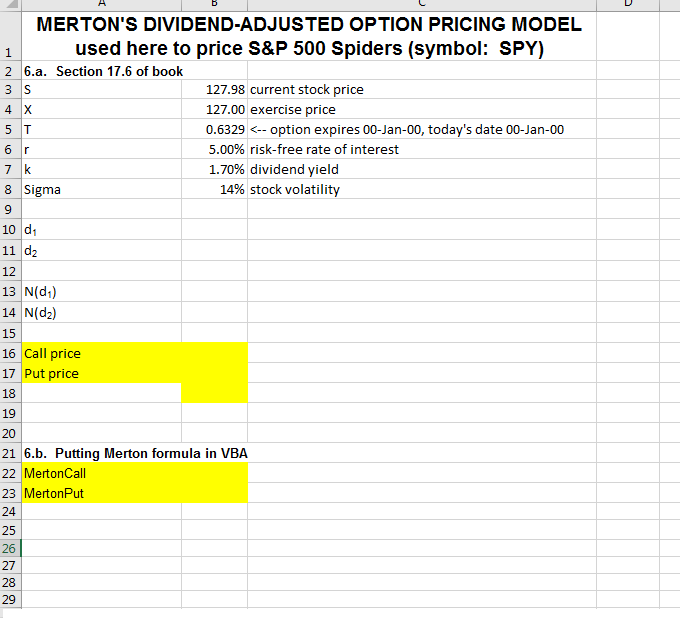

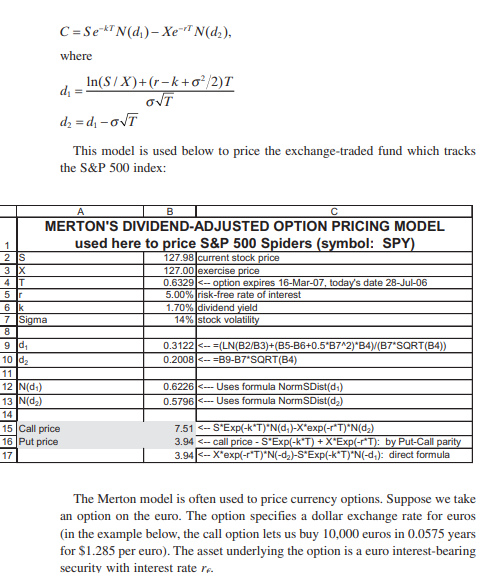

Week 4: Group Assignment Chapter 17 discusses the Merton model. This is a variation on the Black-Scholes model to price options on stocks having a continuous dividend payout. This model is often used to price options on indices like the SP500) or foreign currency options. The European call option price in the Merton model is: C = Ses* N(d)- Xer" (d,), where In(S/ X)+(-- k + 0* /2)T d, OVT d, = d, -oT Here all the symbols have their usual meaning. The symbol k stands for the average dividend yield on the stock. (For example, the dividend yield of the SP500 is approximately 2%.) Instructions: Question A: The top part of the template for this question is the book example from section 17.6. Fill in the appropriate formulas to price a Merton option. Question B: The spreadsheet has embedded in it the Black-Scholes model in the book (i.e., the functions BSCall and BSPut which depend on the functions Done and Dtwo). Create new VBA functions called MertonDone, MertonDtwo, MertonCall, MertonPut in order to create VBA functions for the Merton model. To do this, you have to add a variable to each of the functions. I suggest you call this variable Dividend. Thus each of your functions will have the form MertonDone(Stock, Exercise, Time, Interest, Dividend, sigma). Question C: Show that these new functions work in the example from the book Question B: Now show the following equivalence: MertonCall(S,X,T,r,k,0) = MertonPut(X,S,1,k,r,0) MertonPut(S,X,T,r,k,0)= MertonCall (X,S,1,k,r,0) 6 r MERTON'S DIVIDEND-ADJUSTED OPTION PRICING MODEL 1 used here to price S&P 500 Spiders (symbol: SPY) 2 6.a. Section 17.6 of book 3 S 127.98 current stock price 4 X 127.00 exercise price 5 T 0.6329

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts