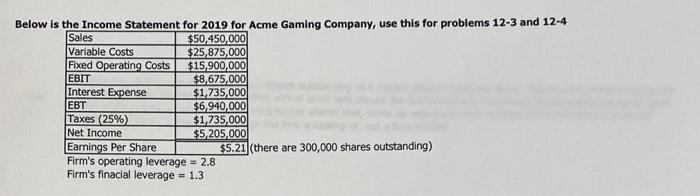

Question: Below is the Income Statement Sales Variable Costs Fixed Operating Costs EBIT Interest Expense EBT Taxes (25%) Net Income Earnings Per Share Firm's operating leverage

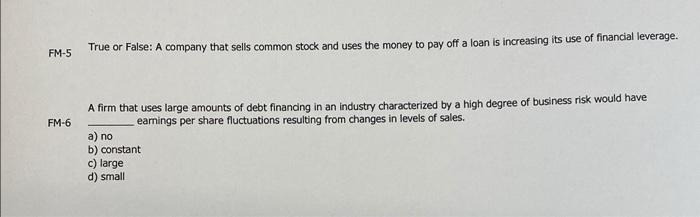

Below is the Income Statement Sales Variable Costs Fixed Operating Costs EBIT Interest Expense EBT Taxes (25%) Net Income Earnings Per Share Firm's operating leverage = 2.8 Firm's finacial leverage = 1.3 for 2019 for Acme Gaming Company, use this for problems 12-3 and 12-4 $50,450,000 $25,875,000 $15,900,000 $8,675,000 $1,735,000 $6,940,000 $1,735,000 $5,205,000 $5.21 (there are 300,000 shares outstanding) FM-5 True or False: A company that sells common stock and uses the money to pay off a loan is increasing its use of financial leverage. A firm that uses large amounts of debt financing in an industry characterized by a high degree of business risk would have earnings per share fluctuations resulting from changes in levels of sales. FM-6 a) no b) constant c) large d) small

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts