Question: Below is the respective balance sheet reported by two well-known Singaporean banks, as found in their financial statements, disclosed in 2021. (a) Compare the size

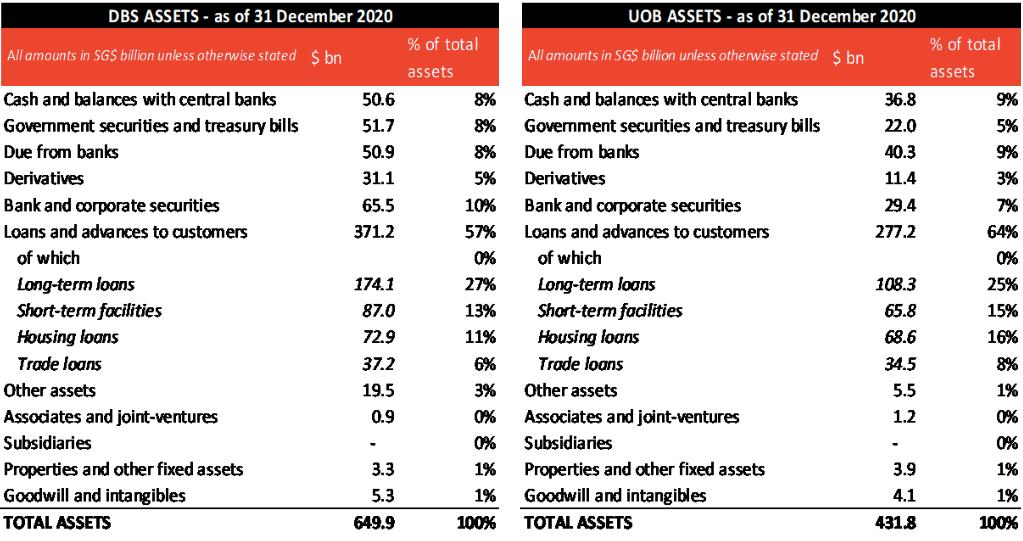

Below is the respective balance sheet reported by two well-known Singaporean banks, as found in their financial statements, disclosed in 2021.

(a) Compare the size and composition of the loan books of DBS and UOB.

(b) Common types of loans include mortgages, credit cards, and trade loans.

Describe those three (3) types of loans and their characteristics in terms of size, maturity, and risk-pricing by filling the table provided below.

| Type of Loans | Mortgages | Credit Cards | Corporate Trade Loans |

| Size (Large, Medium, or small) | |||

| Maturity (Long, Medium, or Short) | |||

| Risk-pricing (high, moderate, low) |

(c) The following table lists three different loans with their pricing, risk, and maturity profile. The current risk-free rate on a one-year loan is estimated to be 0.5%. The credit risk spread for a one-year maturity priced on the market today is 0.4% for a BBB+ rating counterparty, 1.5% for BB+, and 7% for B+. You may assume that all other factors (capital charge, liquidity funding, processing costs, taxes, legal bills and other charges) are considered equal among the loans and represent a flat 1% of the loan amount.

Appraise the pricing of those loans and identify mispriced deals.

| Loan Situations | Loan (A) | Loan (B) | Loan (C) |

| Loan pricing in annual % | 2.3% | 5.3% | 4.3% |

| Risk profile expressed in Standard & Poor's rating | BBB+ | B+ | BB+ |

| Maturity in year | 1.2 | 4.9 | 0.5 |

(d)

The following table lists five different business plans looking for debt financing:

1. The quick refurbishing and renovation of a few hotel rooms that can pay back within a year.

2. The acquisition of expensive equipment by a warehouse that will benefit only after 3 years.

3. The purchase of merchandise by a creditworthy department store ahead of seasonal Christmas sales.

4. Permanent financial support for a major firm on the look-out for acquisitions of competitors.

5. The periodic funding of operational costs for a commodity trader with a weak credit record.

Indicate the most appropriate type of loan for each of the above five purposes.

DBS ASSETS as of 31 December 2020 All amounts in SGS billion unless otherwise stated $bn Cash and balances with central banks Government securities and treasury bills Due from banks Derivatives Bank and corporate securities Loans and advances to customers of which Long-term loans Short-term facilities Housing loans Trade loans Other assets Associates and joint-ventures Subsidiaries Properties and other fixed assets Goodwill and intangibles TOTAL ASSETS 50.6 51.7 50.9 31.1 65.5 371.2 174.1 87.0 72.9 37.2 19.5 0.9 - 3.3 5.3 649.9 % of total assets UOB ASSETS - as of 31 December 2020 All amounts in SGS billion unless otherwise stated $bn 1% 1% 100% 8% 8% 8% Due from banks 5% Derivatives Cash and balances with central banks Government securities and treasury bills 10% Bank and corporate securities 57% Loans and advances to customers 0% of which 27% 13% 11% 6% 3% 0% 0% Long-term loans Short-term facilities Housing loans Trade loans Other assets Associates and joint-ventures Subsidiaries Properties and other fixed assets Goodwill and intangibles TOTAL ASSETS 36.8 22.0 40.3 11.4 29.4 277.2 108.3 65.8 68.6 34.5 5.5 1.2 3.9 4.1 431.8 % of total assets 9% 5% 9% 3% 7% 64% 0% 25% 15% 16% 8% 1% 0% 0% 1% 1% 100%

Step by Step Solution

There are 3 Steps involved in it

For question a we have two images showing the balance sheets for DBS and UOB depicting their asset distribution as of December 31 2020 To compare the size and composition of the loan books of DBS and ... View full answer

Get step-by-step solutions from verified subject matter experts