Question: Below is what you need for the question (Stream immunization e) A company faces a stream of obligations over the next 8 years as shown:

Below is what you need for the question

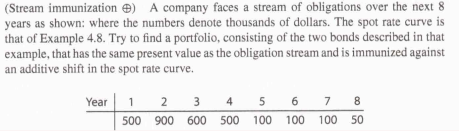

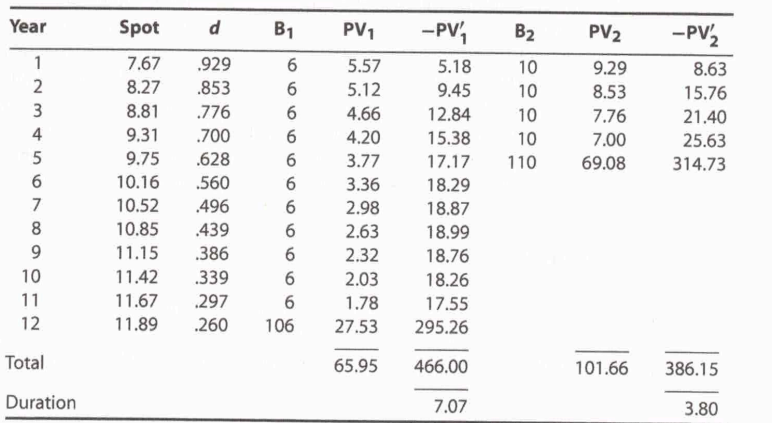

(Stream immunization e) A company faces a stream of obligations over the next 8 years as shown: where the numbers denote thousands of dollars. The spot rate curve is that of Example 4.8. Try to find a portfolio, consisting of the two bonds described in that example, that has the same present value as the obligation stream and is immunized against an additive shift in the spot rate curve. 7 Year 1 2 3 4 5 6 7 8 2 3 500 900 600 500 100 100 100 50 Year Spot d B1 PV1 PV2 WN B2 10 10 10 10 110 9.29 8.53 7.76 7.00 69.08 -PV2 8.63 15.76 21.40 25.63 314.73 1 2 3 4 5 6 7 8 9 10 11 12 7.67 8.27 8.81 9.31 9.75 10.16 10.52 10.85 11.15 11.42 11.67 11.89 .929 .853 .776 .700 .628 .560 .496 .439 386 .339 .297 .260 6 6 6 6 6 6 6 6 6 6 6 106 5.57 5.12 4.66 4.20 3.77 3.36 2.98 2.63 2.32 2.03 1.78 27.53 -PV 5.18 9.45 12.84 15.38 17.17 18.29 18.87 18.99 18.76 18.26 17.55 295.26 Total 65.95 466.00 101.66 386.15 Duration 7.07 3.80 (Stream immunization e) A company faces a stream of obligations over the next 8 years as shown: where the numbers denote thousands of dollars. The spot rate curve is that of Example 4.8. Try to find a portfolio, consisting of the two bonds described in that example, that has the same present value as the obligation stream and is immunized against an additive shift in the spot rate curve. 7 Year 1 2 3 4 5 6 7 8 2 3 500 900 600 500 100 100 100 50 Year Spot d B1 PV1 PV2 WN B2 10 10 10 10 110 9.29 8.53 7.76 7.00 69.08 -PV2 8.63 15.76 21.40 25.63 314.73 1 2 3 4 5 6 7 8 9 10 11 12 7.67 8.27 8.81 9.31 9.75 10.16 10.52 10.85 11.15 11.42 11.67 11.89 .929 .853 .776 .700 .628 .560 .496 .439 386 .339 .297 .260 6 6 6 6 6 6 6 6 6 6 6 106 5.57 5.12 4.66 4.20 3.77 3.36 2.98 2.63 2.32 2.03 1.78 27.53 -PV 5.18 9.45 12.84 15.38 17.17 18.29 18.87 18.99 18.76 18.26 17.55 295.26 Total 65.95 466.00 101.66 386.15 Duration 7.07 3.80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts