Question: Below the problem is my work but I'm getting the wrong answer for the NPV Problem 6-24 Calculating Project NPV Market Top Investors, Inc., is

Below the problem is my work but I'm getting the wrong answer for the NPV

Below the problem is my work but I'm getting the wrong answer for the NPV

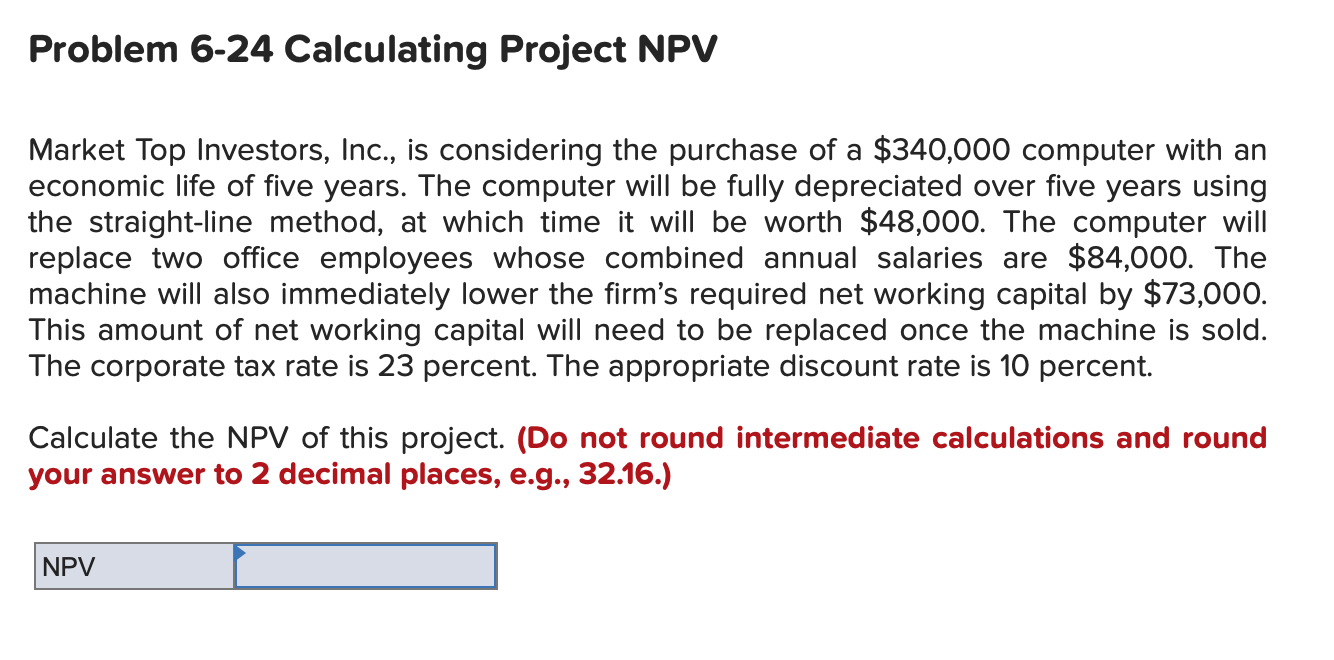

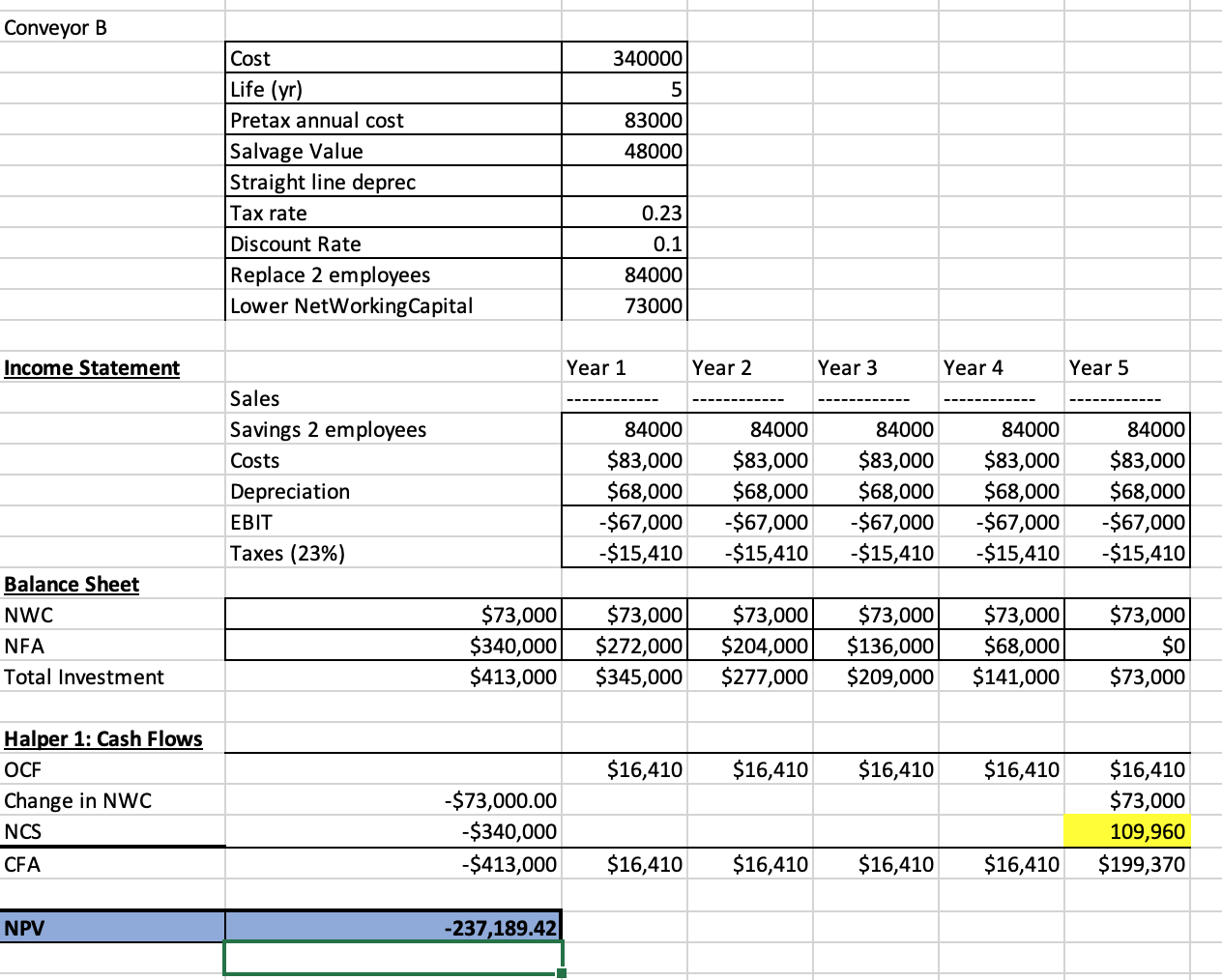

Problem 6-24 Calculating Project NPV Market Top Investors, Inc., is considering the purchase of a $340,000 computer with an economic life of five years. The computer will be fully depreciated over five years using the straight-line method, at which time it will be worth $48,000. The computer will replace two office employees whose combined annual salaries are $84,000. The machine will also immediately lower the firm's required net working capital by $73,000. This amount of net working capital will need to be replaced once the machine is sold. The corporate tax rate is 23 percent. The appropriate discount rate is 10 percent. Calculate the NPV of this project. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Conveyor B 340000 5 83000 48000 Cost Life (yr) Pretax annual cost Salvage Value Straight line deprec Tax rate Discount Rate Replace 2 employees Lower NetWorking Capital 0.23 0.1 84000 73000 Income Statement Year 1 Year 2 Year 3 Year 4 Year 5 Sales Savings 2 employees Costs Depreciation EBIT Taxes (23%) 84000 $83,000 $68,000 -$67,000 -$15,410 84000 $83,000 $68,000 -$67,000 -$15,410 84000 $83,000 $68,000 -$67,000 -$15,410 84000 $83,000 $68,000 -$67,000 -$15,410 84000 $83,000 $68,000 -$67,000 -$15,410 Balance Sheet NWC NFA Total Investment $73,000 $340,000 $413,000 $73,000 $272,000 $345,000 $73,000 $204,000 $277,000 $73,000 $136,000 $209,000 $73,000 $68,000 $141,000 $73,000 $0 $73,000 $16,410 $16,410 $16,410 $16,410 Halper 1: Cash Flows OCF Change in NWC NCS -$73,000.00 -$340,000 -$413,000 $16,410 $73,000 109,960 $199,370 CFA $16,410 $16,410 $16,410 $16,410 NPV -237,189.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts