Question: Below you will find additional Information you might need to complete the assignement 1) We did not sell any Marketable Securities 2) Proceeds from the

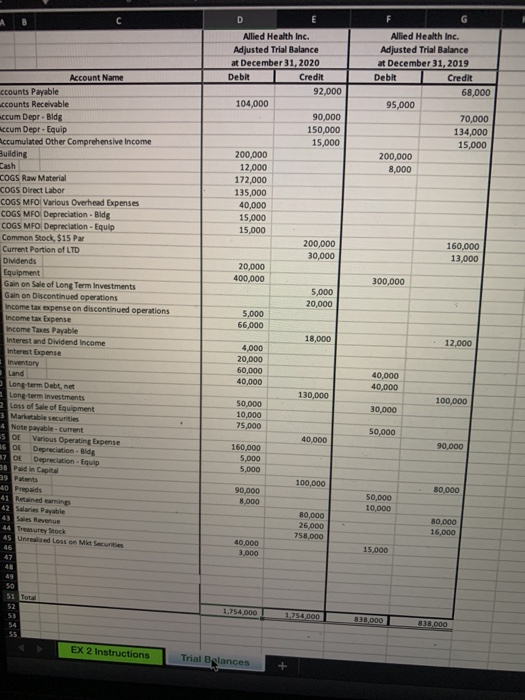

Below you will find additional Information you might need to complete the assignement 1) We did not sell any Marketable Securities 2) Proceeds from the sale of equipment, with a cost of $34,000, was $20,000 3) The Long-term investments that were sold had NO cost basis, le BV was zero 4) Gain on sale of Discontinued Operations was totally from Operations, NO assets were sold Also on the tab "Trial Balances" are the beginning and ending trial balances for 2020 in alphabetical order, NOT in classification order, or Chart of Accounts order. You will therefore have to figure out were the items go in the requirements below. Between the trial balances and the additional information you are required to do the following: 1) The formal Multi-Step income statement for 2020 2) The formal statement of Retained earnings for 2020 3) The formal Classified Balance Sheet for 2020 4) The formal Statement of Cash Flows for 2020 5) Had the company had the following Comprehensive income items prepare the Schedule of Comprehensive income based upon the income arrived at in 1 above a) Foreign currency translation Gain of $10,000, net of tax b) Cost of Defined Benefits plans is $7,000, net of tax A B Allied Health Inc. Adjusted Trial Balance at December 31, 2019 Debit Credit 68,000 95,000 70,000 134,000 15,000 200,000 8,000 160,000 13,000 Account Name ccounts Payable accounts Receivable ccum Depr - Bldg Accum Depr - Equip Accumulated Other Comprehensive Income Building Cash COGS Raw Material COGS Direct Labor COGS MFO Various Overhead Expenses COGS MFO Depreciation - Bldg COGS MFO Depreciation - Equip Common Stock $15 Par Current Portion of LTD Dividends Equipment Gain on Sale of Long Term Investments Gain on Discontinued operations Income tax expense on discontinued operations Income tax Expense Income Taxes Payable Interest and Dividend Income Interest Expense Inventory Land Long-term Debt, net Long-term investments 2 Loss of Sale of Equipment 3 Martable securities 4 Note payable current ot Various Operating Expense 16 OF Depreciation - Bldg 37 OE Depreciation Equip 300,000 D Allied Health Inc. Adjusted Trial Balance at December 31, 2020 Debit Credit 92,000 104,000 90,000 150,000 15,000 200,000 12,000 172,000 135,000 40,000 15,000 15,000 200,000 30,000 20,000 400,000 5,000 20,000 5,000 66,000 18,000 4,000 20,000 60,000 40,000 130,000 50,000 10,000 75,000 40,000 160,000 5,000 5,000 100,000 90,000 8.000 80,000 26,000 758,000 40.000 3,000 12,000 40,000 40,000 100,000 30,000 50,000 90.000 39 Patents 80,000 50,000 10,000 42 Salaries Payable 80,000 16,000 44 Treasury Stock 45 Ured Loss on Mit Securities 46 47 15,000 0 51 Total 52 1.754.000 1.254.000 BBDOO 54 BJ8000 EX 2 Instructions Trial Balances Below you will find additional Information you might need to complete the assignement 1) We did not sell any Marketable Securities 2) Proceeds from the sale of equipment, with a cost of $34,000, was $20,000 3) The Long-term investments that were sold had NO cost basis, le BV was zero 4) Gain on sale of Discontinued Operations was totally from Operations, NO assets were sold Also on the tab "Trial Balances" are the beginning and ending trial balances for 2020 in alphabetical order, NOT in classification order, or Chart of Accounts order. You will therefore have to figure out were the items go in the requirements below. Between the trial balances and the additional information you are required to do the following: 1) The formal Multi-Step income statement for 2020 2) The formal statement of Retained earnings for 2020 3) The formal Classified Balance Sheet for 2020 4) The formal Statement of Cash Flows for 2020 5) Had the company had the following Comprehensive income items prepare the Schedule of Comprehensive income based upon the income arrived at in 1 above a) Foreign currency translation Gain of $10,000, net of tax b) Cost of Defined Benefits plans is $7,000, net of tax A B Allied Health Inc. Adjusted Trial Balance at December 31, 2019 Debit Credit 68,000 95,000 70,000 134,000 15,000 200,000 8,000 160,000 13,000 Account Name ccounts Payable accounts Receivable ccum Depr - Bldg Accum Depr - Equip Accumulated Other Comprehensive Income Building Cash COGS Raw Material COGS Direct Labor COGS MFO Various Overhead Expenses COGS MFO Depreciation - Bldg COGS MFO Depreciation - Equip Common Stock $15 Par Current Portion of LTD Dividends Equipment Gain on Sale of Long Term Investments Gain on Discontinued operations Income tax expense on discontinued operations Income tax Expense Income Taxes Payable Interest and Dividend Income Interest Expense Inventory Land Long-term Debt, net Long-term investments 2 Loss of Sale of Equipment 3 Martable securities 4 Note payable current ot Various Operating Expense 16 OF Depreciation - Bldg 37 OE Depreciation Equip 300,000 D Allied Health Inc. Adjusted Trial Balance at December 31, 2020 Debit Credit 92,000 104,000 90,000 150,000 15,000 200,000 12,000 172,000 135,000 40,000 15,000 15,000 200,000 30,000 20,000 400,000 5,000 20,000 5,000 66,000 18,000 4,000 20,000 60,000 40,000 130,000 50,000 10,000 75,000 40,000 160,000 5,000 5,000 100,000 90,000 8.000 80,000 26,000 758,000 40.000 3,000 12,000 40,000 40,000 100,000 30,000 50,000 90.000 39 Patents 80,000 50,000 10,000 42 Salaries Payable 80,000 16,000 44 Treasury Stock 45 Ured Loss on Mit Securities 46 47 15,000 0 51 Total 52 1.754.000 1.254.000 BBDOO 54 BJ8000 EX 2 Instructions Trial Balances

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts