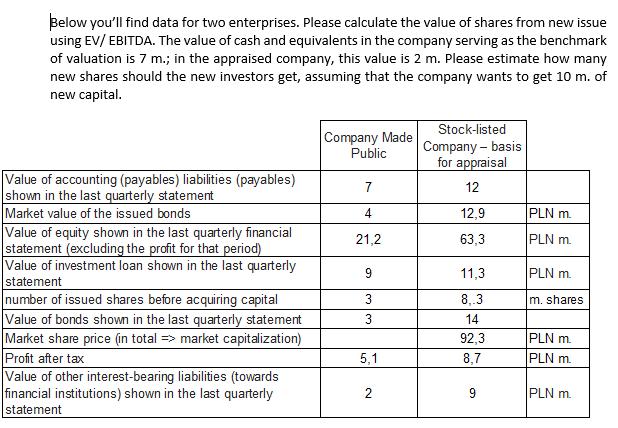

Question: Below you'll find data for two enterprises. Please calculate the value of shares from new issue using EV/ EBITDA. The value of cash and

Below you'll find data for two enterprises. Please calculate the value of shares from new issue using EV/ EBITDA. The value of cash and equivalents in the company serving as the benchmark of valuation is 7 m.; in the appraised company, this value is 2 m. Please estimate how many new shares should the new investors get, assuming that the company wants to get 10 m. of new capital. Value of accounting (payables) liabilities (payables) shown in the last quarterly statement Market value of the issued bonds Value of equity shown in the last quarterly financial statement (excluding the profit for that period) Value of investment loan shown in the last quarterly statement number of issued shares before acquiring capital Value of bonds shown in the last quarterly statement Market share price (in total => market capitalization) Profit after tax Value of other interest-bearing liabilities (towards financial institutions) shown in the last quarterly statement Company Made Public 7 4 21,2 9 3 3 5,1 2 Stock-listed Company - basis for appraisal 12 12,9 63,3 11,3 8,.3 14 92,3 8,7 9 PLN m PLN m PLN m. m. shares PLN m PLN m. PLN m

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

To calculate the value of shares from the new issue using EVEBITDA we need the following information For the Company Made Public Value of cash and equ... View full answer

Get step-by-step solutions from verified subject matter experts