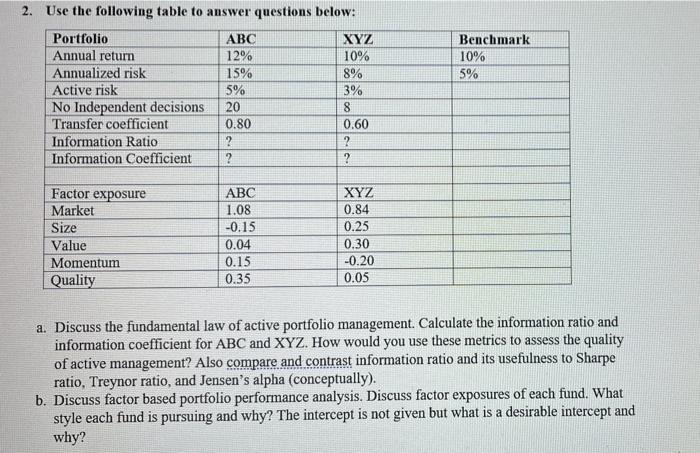

Question: Benchmark 10% 5% 2. Use the following table to answer questions below: Portfolio ABC XYZ Annual return 12% 10% Annualized risk 15% 8% Active risk

Benchmark 10% 5% 2. Use the following table to answer questions below: Portfolio ABC XYZ Annual return 12% 10% Annualized risk 15% 8% Active risk 5% 3% No Independent decisions 20 8 Transfer coefficient 0.80 0.60 Information Ratio 2 ? Information Coefficient 2 ? Factor exposure Market Size Value Momentum Quality ABC 1.08 -0.15 0.04 0.15 0.35 XYZ 0.84 0.25 0.30 -0.20 0.05 a. Discuss the fundamental law of active portfolio management. Calculate the information ratio and information coefficient for ABC and XYZ. How would you use these metrics to assess the quality of active management? Also compare and contrast information ratio and its usefulness to Sharpe ratio, Treynor ratio, and Jensen's alpha (conceptually). b. Discuss factor based portfolio performance analysis. Discuss factor exposures of each fund. What style each fund is pursuing and why? The intercept is not given but what is a desirable intercept and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts