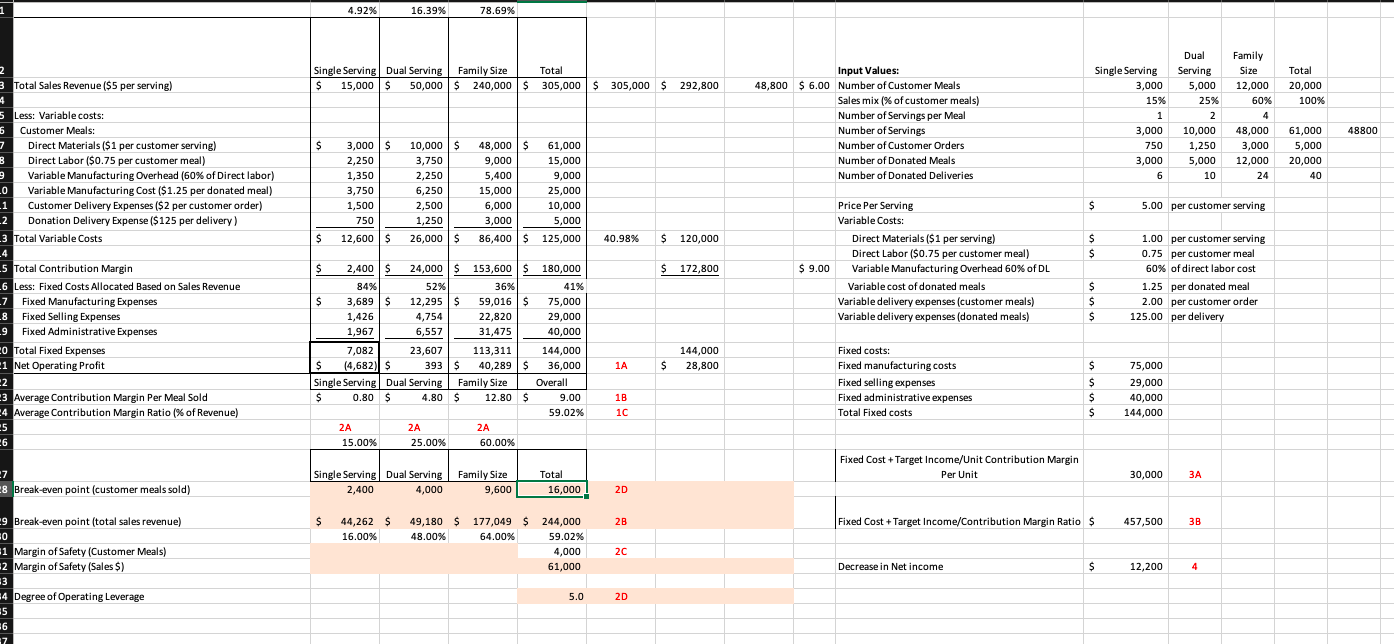

Question: Bene Petit First Year Operating Data:Single ( 1 serving ) Dual ( 2 servings ) Family ( 4 servings ) Additional information about selling prices,

Bene Petit First Year Operating Data:Single servingDual servingsFamily servings

Additional information about selling prices, variable costs, and fixed costs is summarized below:

The average sales price for customer meals is $ per serving.

The average direct materials ingredients cost of customer meals is $ per serving.

Direct labor costs average $ per customer meal.

Variable manufacturing overhead costs are applied at a rate equal to of direct labor.

The delivery expense for customer meals is $ per customer order.

The incremental cost of producing the donated meals is $ per meal.

The delivery expense for donated meals is $ per delivery to community partners.

The following fixed costs are allocated to customer meals based on total sales revenue:

Fixed manufacturing overhead costs are $ per year.

Fixed selling expenses are $ per year.

Fixed administrative expenses are $ per year.

The attached excel file shows a contribution margin income statement based on these starting assumptions.

You should return to this starting spreadsheet for each part of the case below.

Part CVP Analysis startingdata xlsx

If Bene Petit wants to increase net operating income to $ by changing only the selling price per serving, what should the new price be Perform a "what if analysis to see how operating results will change if sales increase by during the second year of operations.

a What is the new net operating income?

Net operating income

b What is the new degree of operating leverage?

Degree of operating leverage

c If sales increased by in the third year, what percentage growth in profit can the company expect?

Percentage growth in profit

d What is the predicted operating profit in year Assume that Taylor is considering raising the price per serving by but expects a corresponding drop in demand. How much would profit increase or decrease compared to the starting profit of $

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock