Question: Benefits covered by Section 132 which may be excluded from an employee's gross income do not include A. employee's use of an employer owned exercise

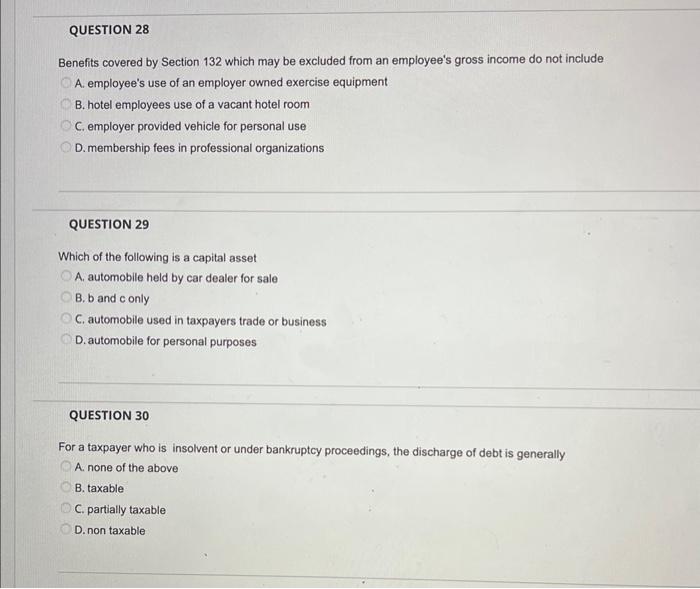

Benefits covered by Section 132 which may be excluded from an employee's gross income do not include A. employee's use of an employer owned exercise equipment B. hotel employees use of a vacant hotel room C. employer provided vehicle for personal use D. membership fees in professional organizations QUESTION 29 Which of the following is a capital asset A. automobile held by car dealer for sale B. b and conly C. automobile used in taxpayers trade or business D. automobile for personal purposes QUESTION 30 For a taxpayer who is insolvent or under bankruptcy proceedings, the discharge of debt is generally A. none of the above B. taxable C. partially taxable D. non taxable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts