Question: Benjamin, age 18 , is claimed as a dependent by his parents in 2022 . He has dividend income of $1,000 and earns $1,700 from

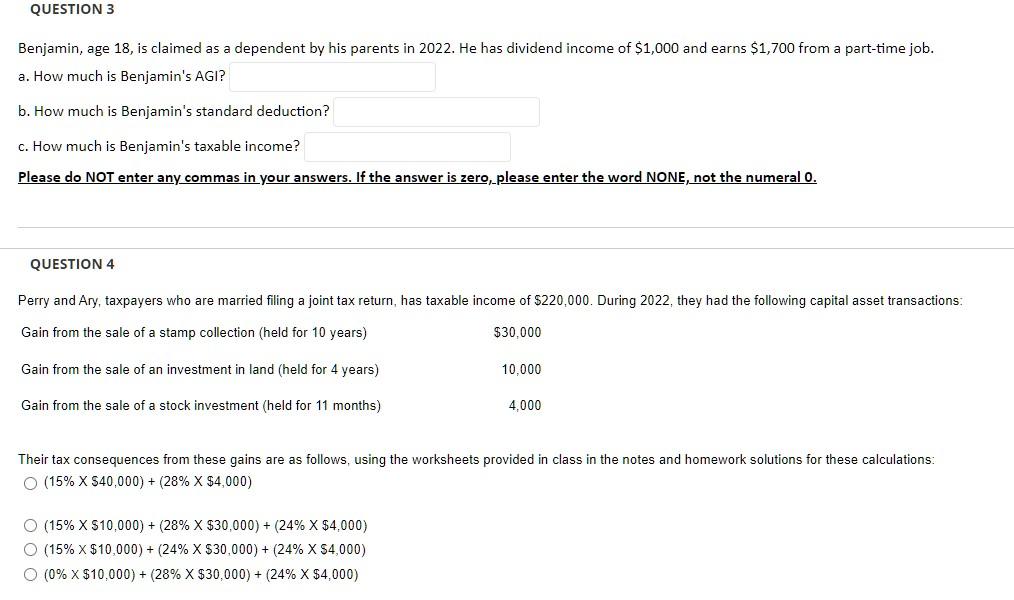

Benjamin, age 18 , is claimed as a dependent by his parents in 2022 . He has dividend income of $1,000 and earns $1,700 from a part-time job. a. How much is Benjamin's AGl? b. How much is Benjamin's standard deduction? c. How much is Benjamin's taxable income? Please do NOT enter any commas in your answers. If the answer is zero, please enter the word NONE, not the numeral 0. QUESTION 4 Perry and Ary, taxpayers who are married filing a joint tax return, has taxable income of $220,000. During 2022 , they had the following capital asset transactions: Their tax consequences from these gains are as follows, using the worksheets provided in class in the notes and homework solutions for these calculations: (15%$40,000)+(28%$4,000) (15%$10,000)+(28%$30,000)+(24%$4,000)(15%$10,000)+(24%$30,000)+(24%$4,000)(0%$10,000)+(28%$30,000)+(24%$4,000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts