Question: Bennett and Barney decide to form a partnership on 01/07/2021. Bennett and Barney operate on an accrual basis with the financial year from 1 July

Bennett and Barney decide to form a partnership on 01/07/2021. Bennett and Barney operate on an accrual basis with the financial year from 1 July to the 30 June the following year.

Partnership proceeds are divided as Bennett (1/3) and Barney (2/3).

The Partnership provided an extract of their Trial balance and additional pertinent information of the partnership to be incorporated in the preparation of three financial accounts and statements at the close of the first financial year of operating 30 June 2022.

Ignore GST for this task.

With Strict adherence to GPC Bookkeeping Services' organisational policies and Procedures complete the following:

- Prepare the partnership Income Statement as at 30 June 2022.

- Prepare the Profit and Loss Appropriation Account.

- Prepare the Partners' current accounts.

- Prepare the Partnership Balance Sheet as at 30 June 2022.

- Bennett and Barney have requested some information on writing their Partnership Polices and procedure manual.

| Trial Balance of Bennett & Barney as at 30 June 2022 | ||

| Debit | Credit | |

| $ | $ | |

| Sales | 1,000,000 | |

| Sales returns | 10,000 | |

| Selling expenses | 150,000 | |

| Administration expenses | 205,000 | |

| Financial expenses | 50,000 | |

| Purchases | 320,000 | |

| Cash at bank | 77,000 | |

| Accounts receivable | 22,000 | |

| Provision for Doubtful Debts | 2,500 | |

| Inventories | 42,000 | |

| Motor Vehicles | 80,000 | |

| Furniture | 42,000 | |

| Plant and Equipment | 276,500 | |

| Accumulated Depreciation Plant | 1,500 | |

| Accounts payable | 56,000 | |

| Bank Loan | 12,000 | |

| Capital - Bennett | 75,000 | |

| Capital - Barney | 112,500 | |

| Current - Bennett | 25,000 | |

| Current - Barney | 35,000 | |

| Drawings - Bennett | 20,000 | |

| Drawings - Barney | 25,000 | |

| Totals | 1,319,500 | 1,319,500 |

| Additional Information: | ||

| 1. Closing inventories counted as $39,000 | 39000 | |

| 2. Interest on capital at 10% per annum | 10% | |

| 3. Interest on drawings at 12% per annum | 12% | |

| 4. Partners salaries owing $22000 each | 22000 | |

| 5. Drawings for Bennett 01/9/21 $10,000 and 1/3/22 $10,000 | 20000 | |

| 6. Drawings for Barney 01/9/21 $10,000, 01/03/22 $8,000 and 01/06/22$7,000 | 25000 | |

| Income Statement for Bennett & Barney for year ended 30 June 2022 | ||

| Sales | 1,000,000 | |

| Less sales returned | - 10,000 | |

| Closing inventory | 39,000 | |

| Total | 1,029,000 | |

| Opening inventory | 42,000 | |

| Purchases | 320,000 | |

| Total | 362,000 | |

| Gross Profit | 667,000 | |

| Selling expenses | 150,000 | |

| Admin expenses | 205,000 | |

| Financial Expenses | 50,000 | |

| Partners Salary | 44,000 | |

| 449,000 | ||

| Net Profit | 218,000 | |

| Profit & Loss Appropriation for Bennett & Barney for the year ended 30 June 2022 | |||||

| Interest on Capital | 6,000 | Net Profit from Profit & Loss | |||

| 218,000 | |||||

| Interest on Drawings | |||||

| Share of Profit | 214,790 | 2,790 | |||

| Bennett | 71,597 | ||||

| Barney | 143,193 | ||||

| 220,790 | 220,790 | ||||

| Current - Bennett | |||||

| Drowings | 20,000 | Opening Balance | 25,000 | ||

| Interest on drowings | 1000 | Interest on Capital | 2,500 | ||

| 400 | Salary | 22,000 | |||

| 1,400 | Net Profit | 71,597 | |||

| Closing Balance | 99,697 | ||||

| 121,097 | 121,097 | ||||

| Current - Barney | |||||

| Drowings | 25,000 | Opening Balance | 35,000 | ||

| Interest on drowings | 1000 | Interest on Capital | 3,500 | ||

| 320 | Salary | 22,000 | |||

| 70 | 1,390 | Net Profit | 143,193 | ||

| 177,303 | |||||

| 203,693 | 203,693 |

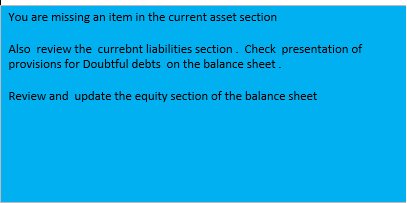

| Balance Sheet of Bennett & Barney for year at 30 June 2022 | |||

| Current Assets | |||

| Cash at the Bank | 77,000 | ||

| Accounts Receivables | 22,000 | ||

| Inventory | 39,000 | ||

| 138,000 | |||

| Non-Current Assets | |||

| Motor vehicle | 80,000 | ||

| Furniture | 42,000 | ||

| Plant and equipment | 276,500 | ||

| Accumulated depreciation plant | - 1,500 | ||

| 397,000 | 535,000 | ||

| Current Liabilities | |||

| Accounts Payable | 56,000 | ||

| Provision for doubtful debts | 2,500 | 58,500 | |

| Non-Current Liabilities | |||

| Bank loan | 12,000 | ||

| 70,500 | |||

| Net Assets | 464,500 | ||

| Equity | |||

| Capital - Bennett | 75,000 | ||

| Capital - Barney | 112,500 | 187,500 | |

| Current - Bennett | 99,697 | ||

| Current - Barney | 177,303 | 277,000 | |

| 535,000 |

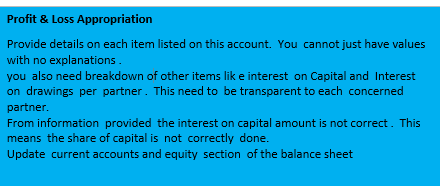

Profit & Loss Appropriation Provide details on each item listed on this account. You cannot just have values with no explanations. you also need breakdown of other items like interest on Capital and Interest on drawings per partner. This need to be transparent to each concerned partner. From information provided the interest on capital amount is not correct. This means the share of capital is not correctly done. Update current accounts and equity section of the balance sheet

Step by Step Solution

There are 3 Steps involved in it

Based on the analysis of the trial balance additional information and the annotations in the blue comment boxes here is a corrected and detailed version of all required financial statements and docume... View full answer

Get step-by-step solutions from verified subject matter experts