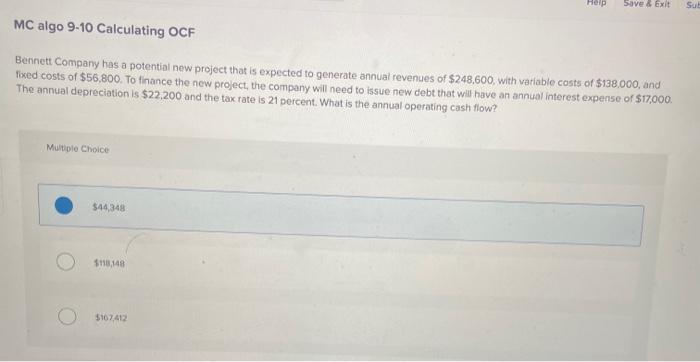

Question: Bennett Company has a potential new project that is expected to generate annual revenues of $248,600, with vatriable costs of $138,000, and fixed costs of

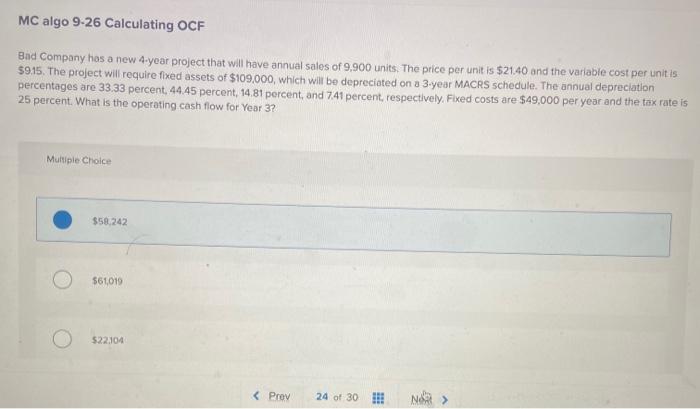

Bennett Company has a potential new project that is expected to generate annual revenues of $248,600, with vatriable costs of $138,000, and fixed costs of $56,800. To finance the new project, the company will need to issue new cebt that will have an annual interest expense of $17,000. The annual depreciation is $22,200 and the tax rate is 21 percent. What is the annual operating cash flow? Mulviple choice 544,348 5118,198 $107,412 Bad Company has a new 4 -year project that will have annual sales of 9,900 units. The price per unit is $21.40 and the variable cost per unit is \$915. The project will require fixed assets of $109,000, which will be depreciated on a 3-year MACRS schedule. The annual depreciation percentages are 33.33 percent, 44.45 percent, 14.81 percent, and 7.41 percent, respectively. Fixed costs are $49,000 per year and the tax rate is 25 percent. What is the operating cash flow for Year 3 ? Muitipie Crioice $58.242 561,019 522104

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts