Question: Benny Beene owns a very profitable ice cream stand. Based on the results of a marketing research project that cost $9,000, Benny is now considering

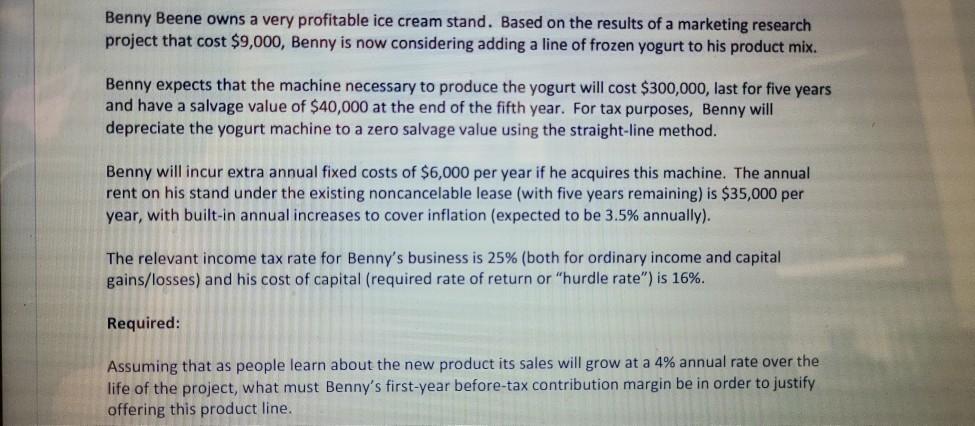

Benny Beene owns a very profitable ice cream stand. Based on the results of a marketing research project that cost $9,000, Benny is now considering adding a line of frozen yogurt to his product mix. Benny expects that the machine necessary to produce the yogurt will cost $300,000, last for five years and have a salvage value of $40,000 at the end of the fifth year. For tax purposes, Benny will depreciate the yogurt machine to a zero salvage value using the straight-line method. Benny will incur extra annual fixed costs of $6,000 per year if he acquires this machine. The annual rent on his stand under the existing noncancelable lease (with five years remaining) is $35,000 per year, with built-in annual increases to cover inflation (expected to be 3.5% annually). The relevant income tax rate for Benny's business is 25% (both for ordinary income and capital gains/losses) and his cost of capital (required rate of return or "hurdle rate") is 16%. Required: Assuming that as people learn about the new product its sales will grow at a 4% annual rate over the life of the project, what must Benny's first-year before-tax contribution margin be in order to justify offering this product line

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts