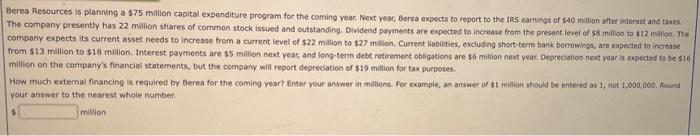

Question: Berea Resources is planning a $75 million capital expenditure program for the coming vear. Next year, Berea expects to report to the IR5 earnings of

Berea Resources is planning a $75 million capital expenditure program for the coming vear. Next year, Berea expects to report to the IR5 earnings of s40 million after intereit and tames The company presently has 22 malion shares of common stock issued and outstanding. Dividend payments are expected to increase from the present level of 58 millon to s12 malion, 7he company expects its current asset needs to increase from a current level of $22 million to $27 malion. Current liabilibes, exduding short-term bank berrowirgs, are expected to inoease from $13 million to $18 milion, interest payments are 55 mililion next year, and long-term debt retiremert obligations are $6 million next year. Deareciation next year is expectid to be $16 million on the company's financial statements, but the company will report depreciation of $19 million for tax purposes. How much external financing is required by Berea for the coming year? Enter your answer in malions. For example, an answer of th million should be entered as 1, not 1,000 , coo. Aound your answer to the nearest whole number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts