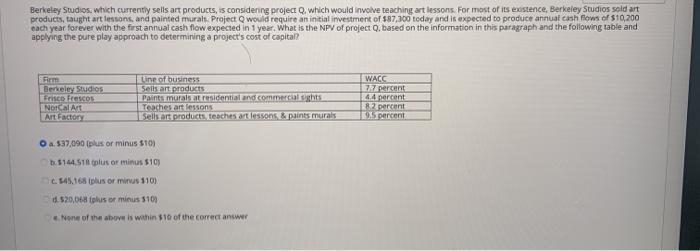

Question: Berkeley Studios, which currently sells art products, is considering project Q which would involve teaching art lessons. For most of its existence, Berkeley Studios sold

Berkeley Studios, which currently sells art products, is considering project Q which would involve teaching art lessons. For most of its existence, Berkeley Studios sold art products, taught art lessons and painted murals. Project would require an initial investment of $87,300 today and is expected to produce annual cash flows of $10,200 each year forever with the first annual cash flow expected in 1 year. What is the NPV of project Q. based on the information in this paragraph and the following table and applying the pure play approach to determining a project's cost of capital? Firm Berkeley Studios Frisco Frescos NOFCA Art Factor Line of business Seils art products Paints murals at residential and commercials Teaches at Lessons Seils art products, teaches art lessons & paints murals WACC percent 6.4 percent 82 percent 9 percent O a. 537,090 plus or minus $10) 1.5144.518 plus or minus 101 c.545.168 plus or minus 110) 1.520,068 plus or minus 5101 None of the above is within 10 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts