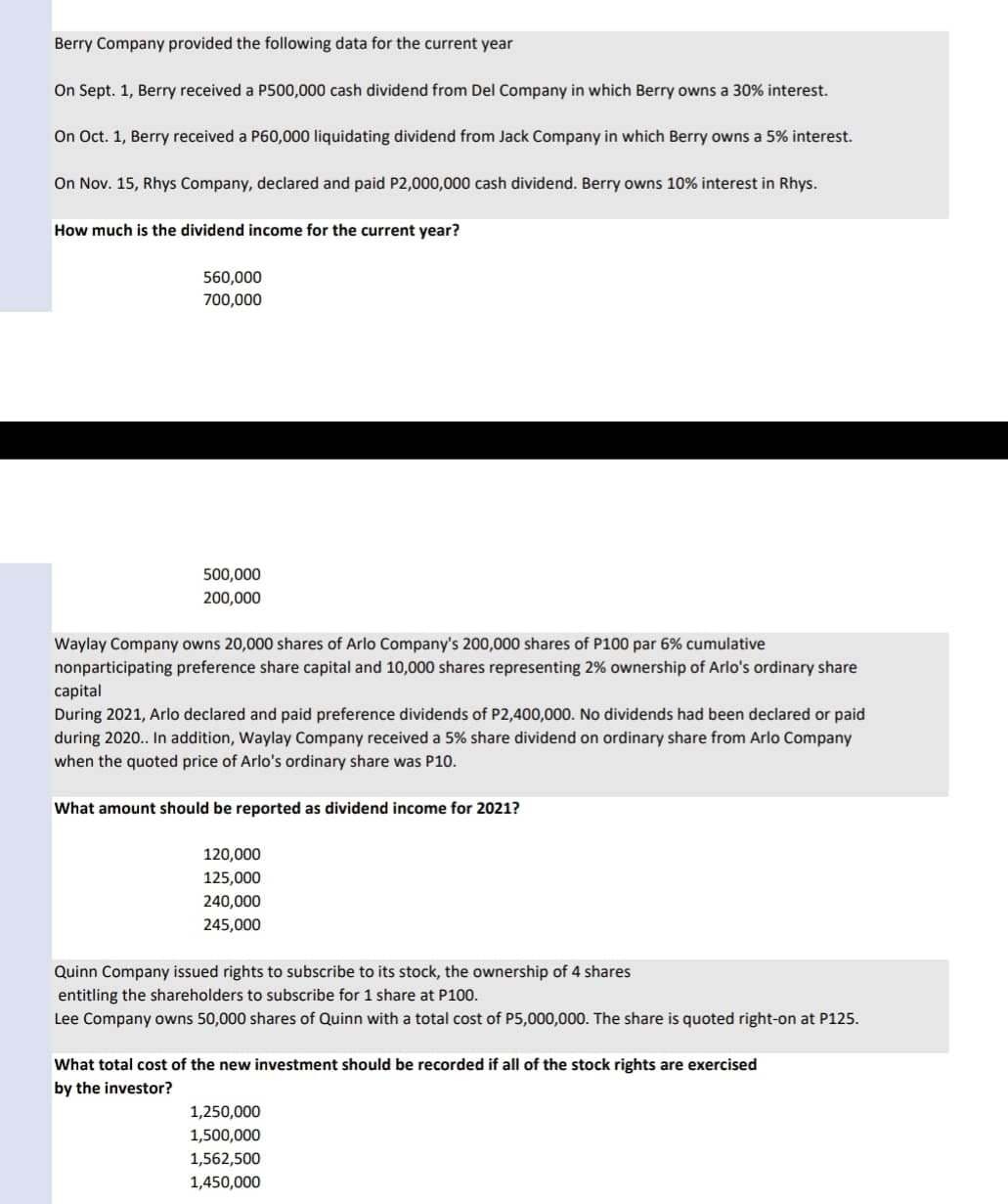

Question: Bern; Company provided the following data for the current year On Sept. 1, Berry received a P500000 cash dividend from Del Company in which Berry

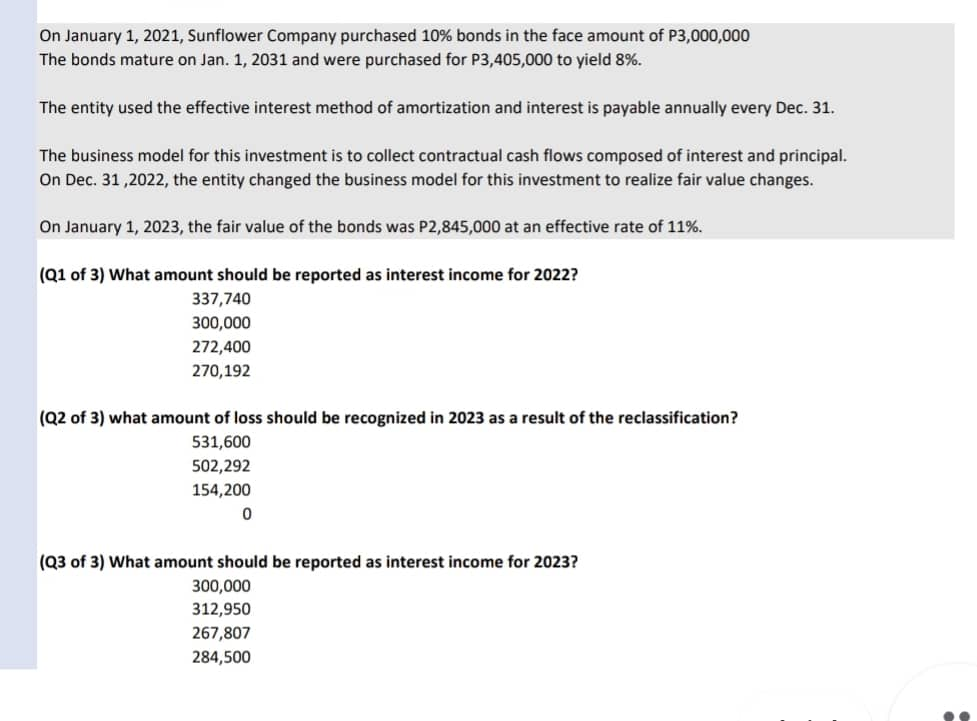

Bern; Company provided the following data for the current year On Sept. 1, Berry received a P500000 cash dividend from Del Company in which Berry owns a 30% interest. On Oct. 1, Berry received a P60,000 liquidating dividend from Jack Company in which Berry owns a 5% interest. On Nov. 15, Rhys Company, declared and paid P2,000,000 cash dividend. Berry owns 10% interest in Rhys. How much Is the dividend income for the current year? 500,000 700,000 500, 000 200, 000 Wayiav Company owns 20,000 shares of Ario Company's 200,000 shares of P1!!! par 6% cumulative non participating preference share capital and 10,000 shares representing 2% ownership of Mo's ordinary share capital During 2021, Aria declared and paid preference dividends of 92,400,0m No dividends had been declared or paid during 2020.. in addition, Waylay Companyr received a 5% share dividend on ordinary share from Arlo Cornpany when the quoted price of Ario's ordinary share was P10. What amount should he reported as dividend income for 2021? 120,000 125,000 240,000 245,000 Quinn Company issued rights to subscribe to its stock, the ownership of 4 shares entitling the shareholders to subscribe for 1 share at P100. Lee Company owns 50,000 shares of Quinn with a total cost of P50111300. The share is quoted right-on at P125. What total cost of the new Investment should he recorded if all ofthe stock rights are exercised by the investor? 1,250,000 1,500,000 1,562,500 1,450,000 On January 1, 2021, Sunflower Company purchased 10% bonds in the face amount of P3,000,000 The bonds mature on Jan. 1, 2031 and were purchased for P3,405,000 to yield 8%. The entity used the effective interest method of amortization and interest is payable annually every Dec. 31. The business model for this investment is to collect contractual cash flows composed of interest and principal. On Dec. 31 ,2022, the entity changed the business model for this investment to realize fair value changes. On January 1, 2023, the fair value of the bonds was P2,845,000 at an effective rate of 11%. (Q1 of 3) What amount should be reported as interest income for 2022? 337,740 300,000 272,400 270,192 (Q2 of 3) what amount of loss should be recognized in 2023 as a result of the reclassification? 531,600 502,292 154,200 0 (Q3 of 3) What amount should be reported as interest income for 2023? 300,000 312,950 267,807 284,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts