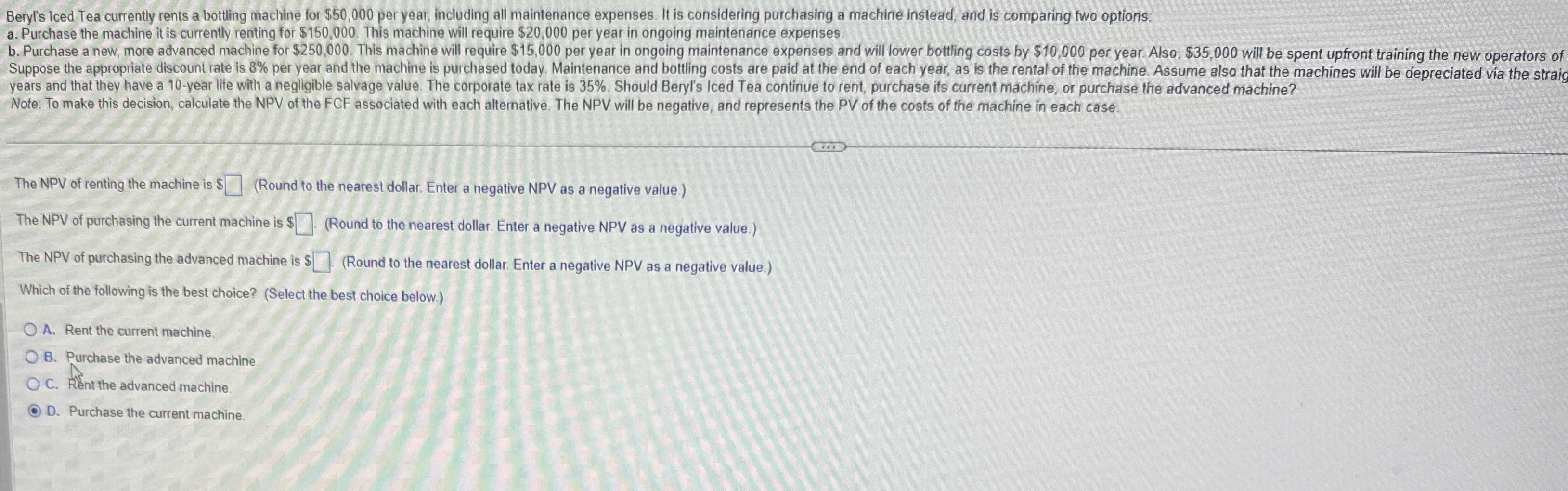

Question: Beryl's Iced Tea currently rents a bottling machine for $ 5 0 , 0 0 0 per year, including all maintenance expenses. It is considering

Beryl's Iced Tea currently rents a bottling machine for $ per year, including all maintenance expenses. It is considering purchasing a machine instead, and is comparing two options:

a Purchase the machine it is currently renting for $ This machine will require $ per year in ongoing maintenance expenses. years and that they have a year life with a negligible salvage value. The corporate tax rate is Should Beryl's Iced Tea continue to rent, purchase its current machine, or purchase the advanced machine?

Note: To make this decision, calculate the NPV of the FCF associated with each alternative. The NPV will be negative, and represents the PV of the costs of the machine in each case.

The NPV of renting the machine is Round to the nearest dollar. Enter a negative NPV as a negative value.

The NPV of purchasing the current machine is $ Round to the nearest dollar. Enter a negative NPV as a negative value.

The NPV of purchasing the advanced machine is $ Round to the nearest dollar. Enter a negative NPV as a negative value.

Which of the following is the best choice? Select the best choice below.

A Rent the current machine.

B Purchase the advanced machine.

C Rnt the advanced machine.

D Purchase the current machine.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock