Question: Best Bagels, Inc. ( BB ) currently has zero debt. Its earnings before interest and taxes ( EBIT ) are $ 1 0 0 ,

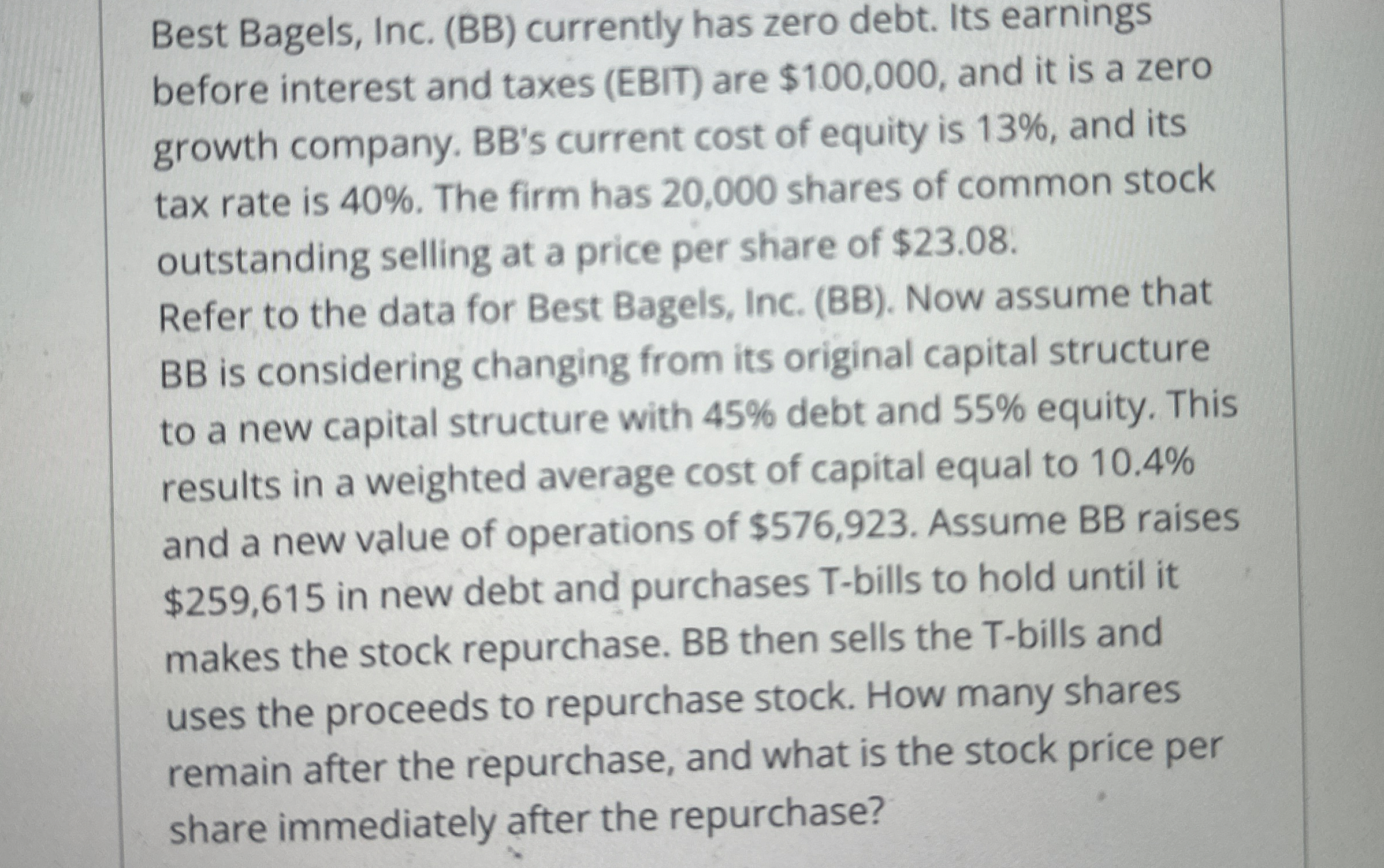

Best Bagels, Inc. BB currently has zero debt. Its earnings before interest and taxes EBIT are $ and it is a zero growth company. BBs current cost of equity is and its tax rate is The firm has shares of common stock outstanding selling at a price per share of $

Refer to the data for Best Bagels, Inc. BB Now assume that is considering changing from its original capital structure to a new capital structure with debt and equity. This results in a weighted average cost of capital equal to and a new value of operations of $ Assume BB raises $ in new debt and purchases Tbills to hold until it makes the stock repurchase. BB then sells the Tbills and uses the proceeds to repurchase stock. How many shares remain after the repurchase, and what is the stock price per share immediately after the repurchase?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock