Question: Best Flight, Inc., is considering two mutually exclusive alternatives A & B for implementing an automated passenger check-in counter at its hub airport. Each alternative

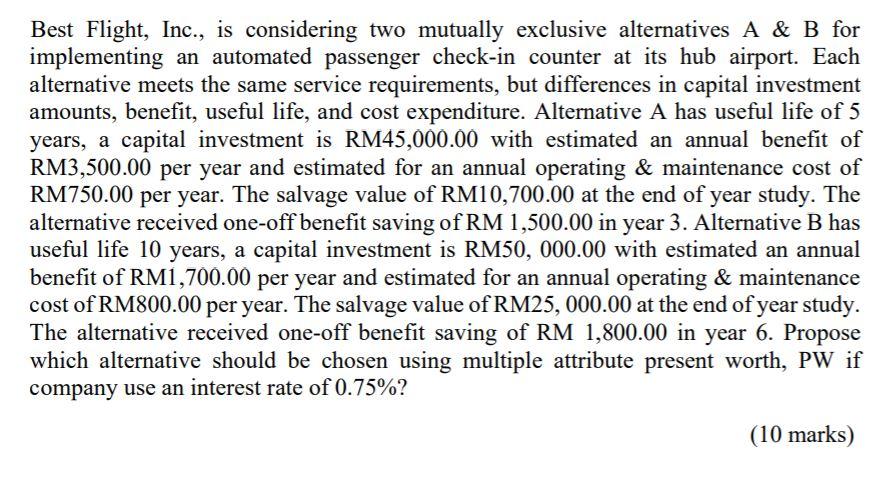

Best Flight, Inc., is considering two mutually exclusive alternatives A & B for implementing an automated passenger check-in counter at its hub airport. Each alternative meets the same service requirements, but differences in capital investment amounts, benefit, useful life, and cost expenditure. Alternative A has useful life of 5 years, a capital investment is RM45,000.00 with estimated an annual benefit of RM3,500.00 per year and estimated for an annual operating & maintenance cost of RM750.00 per year. The salvage value of RM10,700.00 at the end of year study. The alternative received one-off benefit saving of RM 1,500.00 in year 3. Alternative B has useful life 10 years, a capital investment is RM50,000.00 with estimated an annual benefit of RM1,700.00 per year and estimated for an annual operating & maintenance cost of RM800.00 per year. The salvage value of RM25,000.00 at the end of year study. The alternative received one-off benefit saving of RM 1,800.00 in year 6. Propose which alternative should be chosen using multiple attribute present worth, PW if company use an interest rate of 0.75%? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts