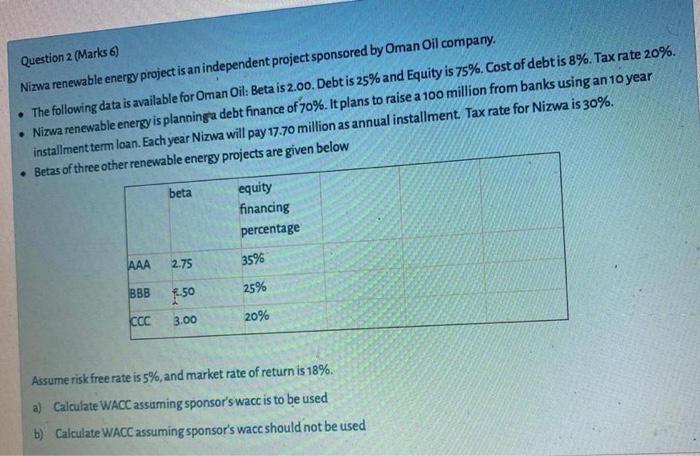

Question: beta AAA. 2.75 BBB. 1.50 CCC. 3.00 Question 2 (Marks 6) Nizwa renewable energy project is an independent project sponsored by Oman Oil company. .

Question 2 (Marks 6) Nizwa renewable energy project is an independent project sponsored by Oman Oil company. . The following data is available for Oman Oil: Beta is 2.00. Debt is 25% and Equity is 75%. Cost of debt is 8%. Tax rate 20%. Nizwa renewable energy is planning a debt finance of 70%. It plans to raise a 100 million from banks using an 10 year installment term loan. Each year Nizwa will pay 17.70 million as annual installment Tax rate for Nizwa is 30%. Betas of three other renewable energy projects are given below beta equity financing percentage AAA 2.75 35% BBB 1.50 25% CCC 3.00 20% Assume risk free rate is 5%, and market rate of return is 18%. a) Calculate WACC assuming sponsor's wacc is to be used b) Calculate WACC assuming sponsor's wacc should not be used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts