Question: beta coefficient, and required return on the stock if the market risk prema an increase in perceived market risk? (portfolio risk) An investor decides to

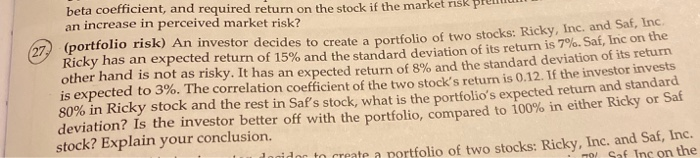

beta coefficient, and required return on the stock if the market risk prema an increase in perceived market risk? (portfolio risk) An investor decides to create a portfolio of two stocks: Ricky Ricky has an expected return of 15% and the standard deviation of its return is 7%. Saf, Inc on the other hand is not as risky. It has an expected return of 8% and the standard deviation of is expected to 3%. The correlation coefficient of the two stock's return is 0.12. If the investor invests 80% in Ricky stock and the rest in Sal's stock, what is the portfolio's expected return and standa deviation? Is the investor better off with the portfolio, compared to 100% in either Ricky or sa stock? Explain your conclusion. Jonidor to create a portfolio of two stocks: Ricky, Inc. and Saf, Inc. . Saf Ins on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts