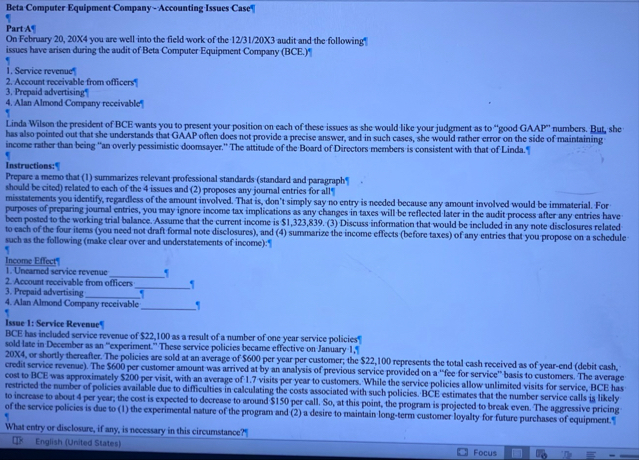

Question: Beta Computer Equipment Company - Accounting Issues Casef 5 Part A On February 2 0 , 2 0 X 4 you are well into the

Beta Computer Equipment Company Accounting Issues Casef

Part A

On February X you are well into the field work of the audit and the following issues have arisen during the audit of Beta Computer Equipment Company BCE

Service revenuef

Account receivable from officers

Prepaid advertising

Alan Almond Company receivablef

Linda Wilson the president of BCE wants you to present your position on each of these issues as she would like your judgment as to "good GAAP" numbers. But, she has also pointed out that she understands that GAAP often does not provide a precise answer, and in such cases, she would rather error on the side of maintaining' income rather than being an overly pessimistic doomsayer." The attitude of the Board of Directors members is consistent with that of Linda.

Instructions:

Prepare a memo that summarizes relevant professional standards standard and paragraph should be cited related to each of the issues and proposes any journal entries for all

misstatements you identify, regardless of the amount involved. That is don't simply say no entry is needed because any amount involved would be immaterial. For purposes of preparing journal entries, you may ignore income tax implications as any changes in taxes will be reflected later in the audit process after any entries have been posted to the working trial balance. Assume that the current income is $ Discuss information that would be included in any note disclosures related to each of the four items you need not draft formal note disclosures and summarize the income effects before taxes of any entries that you propose on a schedule such as the following make clear over and understatements of income:

Income Effect!

Unearned service revenue

Account receivable from otticers

Prepaid advertising

Alan Almond Company receivable

Issue : Service Revenue

BCE has included service revenue of $ as a result of a number of one year service policies $ sold late in December as an "experiment." These service policies became effective on January If

or shortly thereafter. The policies are sold at an average of $ per year per customer; the $ represents the total cash received as of yearend debit cash, credit service revenue The $ per customer amount was arrived at by an analysis of previous service provided on a "fee for service" basis to customers. The average cost to BCE was approximately $ per visit, with an average of visits per year to customers. While the service policies allow unlimited visits for service, BCE has restricted the number of policies available due to difficulties in calculating the costs associated with such policies. BCE estimates that the number service calls is likely to increase to about per year, the cost is expected to decrease to around $ per call. So at this point, the program is projected to break even. The aggressive pricing of the service policies is due to the experimental nature of the program and a desire to maintain longterm customer loyalty for future purchases of equipment.

What entry or disclosure, if any, is necessary in this circumstance?

English United States

FocusIssue : Service Revenue

Answers

RelevantProfessional Standards: Under ASC Revenue from Contracts with Customers, specifically ASC revenue is recognized when or as an entity satisfies a performance obligation by transferring control of a good or service to the customer. Recognition must reflect the amount the entity expects to beentitled to in exchange for those goods or services. ASC to : Revenue should be recognized when a performance obligation is satisfied; when control of the good or service is transferred to the customer. ASC: For service contracts, revenue is generally recognized over time as the services are performed.

Analysis and Proposal: BCE recorded $ as revenue in December for service contracts starting January X even though no services were provided in X Under ASC revenue can only be recognized when a performance obligation is satisfied. Since that hasn't occurred, the amount; should be recorded as Unearned Revenue and recognized evenly over the months of X as the services are performed. Issue : Prepaid

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock