Question: Beta Electric Power Co. (BEP) asks you to evaluate the projected development of a power plant. There are six alternatives: coal, gas, hydro, nuclear, solar,

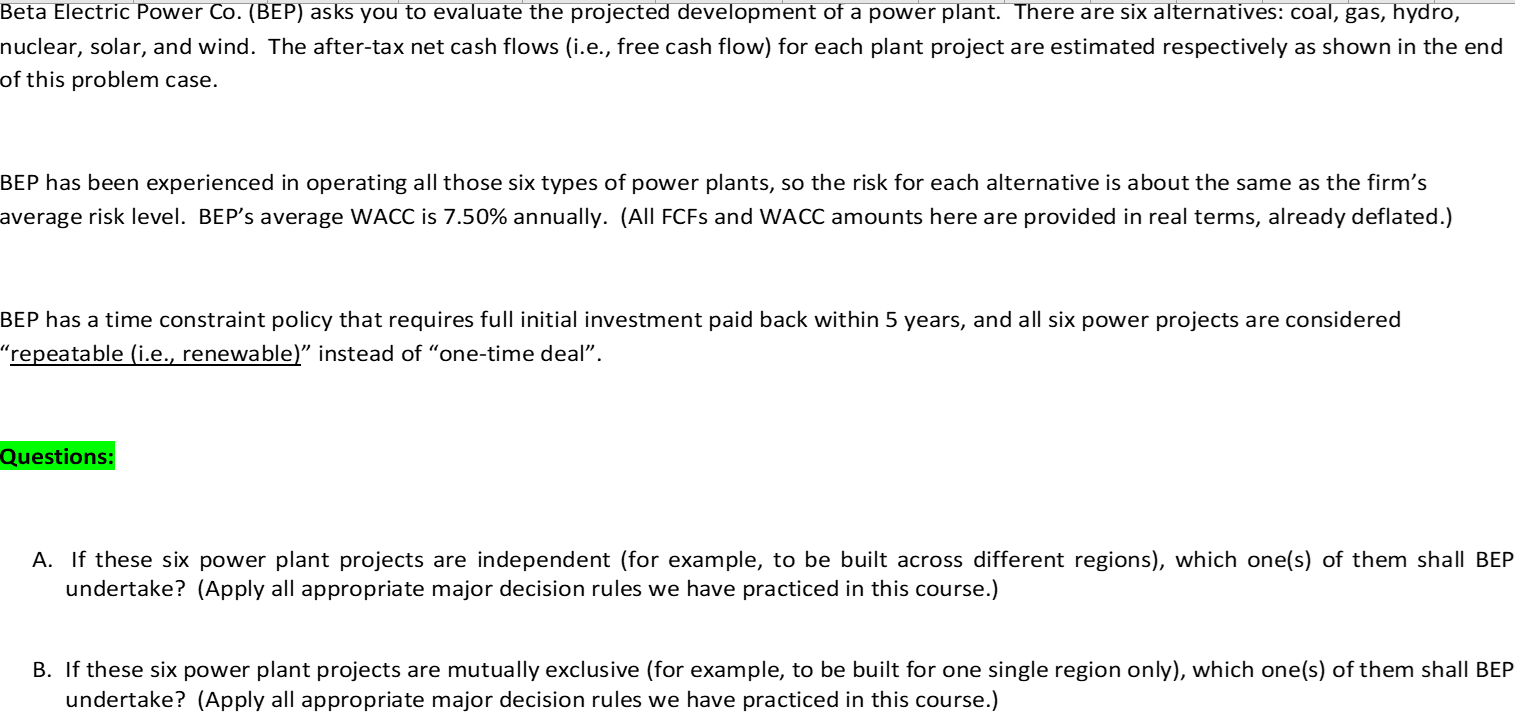

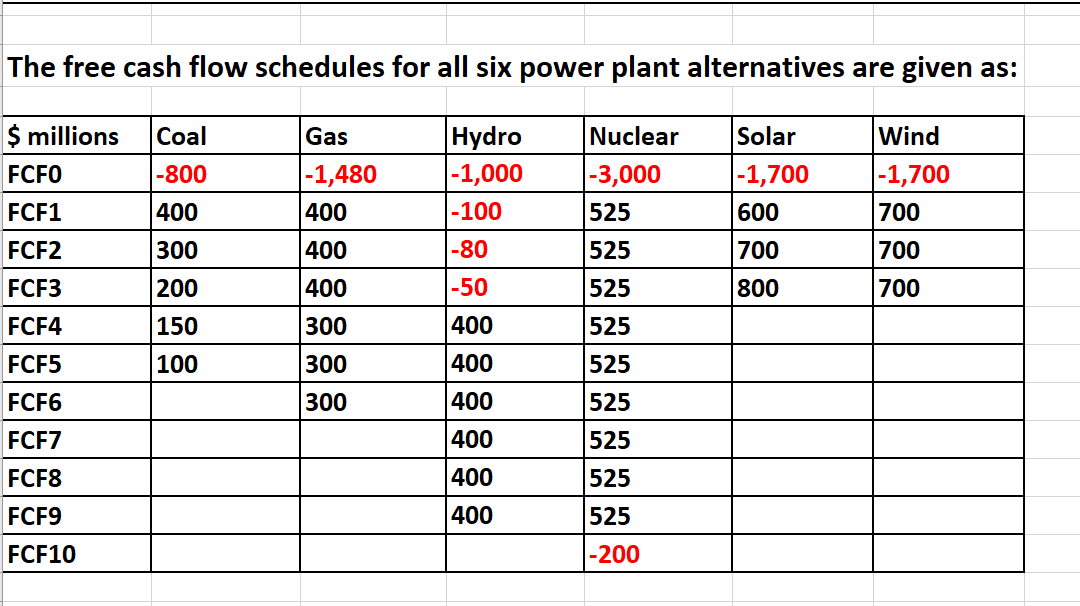

Beta Electric Power Co. (BEP) asks you to evaluate the projected development of a power plant. There are six alternatives: coal, gas, hydro, nuclear, solar, and wind. The after-tax net cash flows (i.e., free cash flow) for each plant project are estimated respectively as shown in the end of this problem case. BEP has been experienced in operating all those six types of power plants, so the risk for each alternative is about the same as the firm's average risk level. BEP's average WACC is 7.50% annually. (All FCFs and WACC amounts here are provided in real terms, already deflated.) BEP has a time constraint policy that requires full initial investment paid back within 5 years, and all six power projects are considered repeatable (i.e., renewable) instead of one-time deal. Questions: A. If these six power plant projects are independent (for example, to be built across different regions), which one(s) of them shall BEP undertake? (Apply all appropriate major decision rules we have practiced in this course.) B. If these six power plant projects are mutually exclusive (for example, to be built for one single region only), which one(s) of them shall BEP undertake? (Apply all appropriate major decision rules we have practiced in this course.) The free cash flow schedules for all six power plant alternatives are given as: Coal $ millions FCFO -800 Gas -1,480 400 Hydro -1,000 - 100 Nuclear -3,000 525 Solar |-1,700 600 Wind |-1,700 700 FCF1 400 FCF2 300 400 -80 525 700 700 200 400 -50 525 800 700 FCF3 FCF4 150 300 400 525 FCF5 100 300 400 525 FCF6 300 400 525 FCF7 400 525 FCF8 400 525 525 400 FCF9 FCF10 -200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts