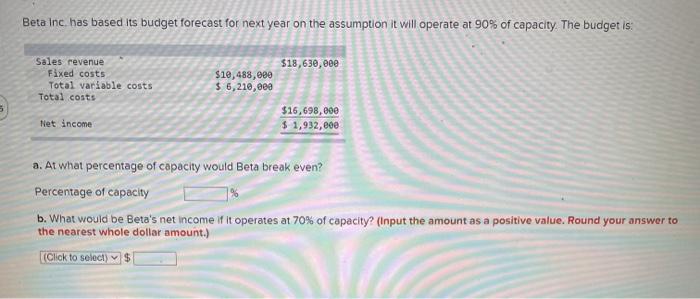

Question: Beta Inc. has based its budget forecast for next year on the assumption it will operate at 90% of capacity. The budget is: $18,630,000 Sales

Beta Inc. has based its budget forecast for next year on the assumption it will operate at 90% of capacity. The budget is: $18,630,000 Sales revenue Fixed costs Total variable costs Total costs $19,488,000 $ 6,210,000 Net income $16,698,000 $ 1,932, 000 a. At what percentage of capacity would Beta break even? Percentage of capacity b. What would be Beta's net income if it operates at 70% of capacity? (Input the amount as a positive value. Round your answer to the nearest whole dollar amount.) (Click to select) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts