Question: Piccolo Ltd is trying to estimate a cost of capital to use in assessing its entry into the marble benchtop market. The publicly traded

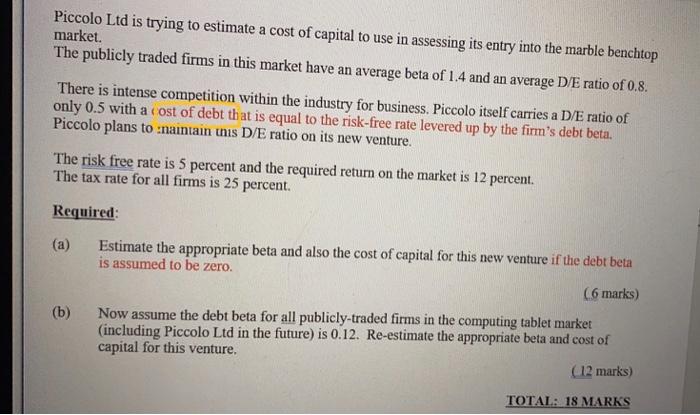

Piccolo Ltd is trying to estimate a cost of capital to use in assessing its entry into the marble benchtop market. The publicly traded firms in this market have an average beta of 1.4 and an average D/E ratio of 0.8. There is intense competition within the industry for business. Piccolo itself carries a D/E ratio of only 0.5 with a cost of debt that is equal to the risk-free rate levered up by the firm's debt beta. Piccolo plans to :naintain unis D/E ratio on its new venture. The risk free rate is 5 percent and the required return on the market is 12 percent. The tax rate for all firms is 25 percent. Required: Estimate the appropriate beta and also the cost of capital for this new venture if the debt beta is assumed to be zero. (a) (6 marks) (b) Now assume the debt beta for all publicly-traded firms in the computing tablet market (including Piccolo Ltd in the future) is 0.12. Re-estimate the appropriate beta and cost of capital for this venture. (12 marks) TOTAL: 18 MARKS

Step by Step Solution

3.48 Rating (148 Votes )

There are 3 Steps involved in it

Answer Ans a Assuming beta of Debt Bd 0 for the industry as well as for Piccolo Now the given Indust... View full answer

Get step-by-step solutions from verified subject matter experts