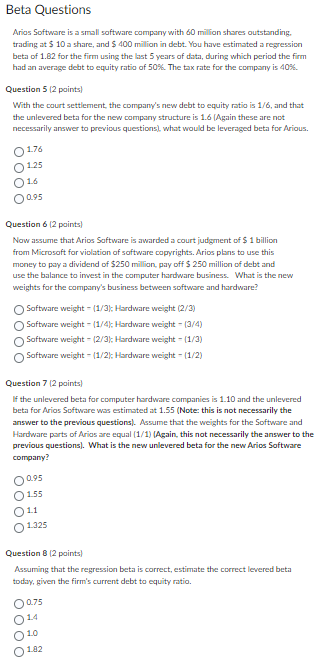

Question: Beta Questions Arias Software is a small software compary with 60 million shares outstanding, trading at $10 a share, and $400 milion in debt. You

Beta Questions Arias Software is a small software compary with 60 million shares outstanding, trading at $10 a share, and $400 milion in debt. You have estimated a regression beta of 1.62 for the firm using the last 5 years of data, during which period the firm had an average debt to equity ratio of 50%. The tax rate for the compony is 40%. Question 5 [2 paints] With the court settlement, the company's new debt to equity ratia is 1/6, and that the unlevered beta far the new campary structure is 1.6 [Again these are not necessarily answer to previous questionsl. what would be levernged beta for Arious. 1.761.251.60.95 Question 6 [2 paints] Now assume that Arios Saftware is awarded a court judgment of $1 billion from Microsoft for violation of software capyrights. Arios plans to use this money to pay a dividend of $250 millian, pay off $250 millicn of debt and use the balance to invest in the computer hartware business. What is the new weights far the campany's business between software and hardware? Software weight - (1/3): Hardware weight (2/3) Software weight - [1/4]: Hardware weight - [3/4) Software weight (2/3}, Hardware weight [1/3) Software weight - (1/2): Hardware weight - [1/2) Question 7 [2 paints] If the unlevered beta far computer hardware companies is 1.10 and the unlevered beta for Arios Software was estimated at 1.55 (Note: this is not necessarily the answer to the previaus questions). Assume that the weights far the Software and Hartware parts of Arias are equal [1/1) (Again, this not necessarily the answer to the previous questions]. What is the new unlevered beta for the new Arios Software company? 0.95 1.55 1.1 1.325 Question 8 [2 paints] Assuming that the regression beta is correct, estimate the correct levered beta todivy, given the firm's current debt to equity matio. 0.75 1.4 10 1.82 Beta Questions Arias Software is a small software compary with 60 million shares outstanding, trading at $10 a share, and $400 milion in debt. You have estimated a regression beta of 1.62 for the firm using the last 5 years of data, during which period the firm had an average debt to equity ratio of 50%. The tax rate for the compony is 40%. Question 5 [2 paints] With the court settlement, the company's new debt to equity ratia is 1/6, and that the unlevered beta far the new campary structure is 1.6 [Again these are not necessarily answer to previous questionsl. what would be levernged beta for Arious. 1.761.251.60.95 Question 6 [2 paints] Now assume that Arios Saftware is awarded a court judgment of $1 billion from Microsoft for violation of software capyrights. Arios plans to use this money to pay a dividend of $250 millian, pay off $250 millicn of debt and use the balance to invest in the computer hartware business. What is the new weights far the campany's business between software and hardware? Software weight - (1/3): Hardware weight (2/3) Software weight - [1/4]: Hardware weight - [3/4) Software weight (2/3}, Hardware weight [1/3) Software weight - (1/2): Hardware weight - [1/2) Question 7 [2 paints] If the unlevered beta far computer hardware companies is 1.10 and the unlevered beta for Arios Software was estimated at 1.55 (Note: this is not necessarily the answer to the previaus questions). Assume that the weights far the Software and Hartware parts of Arias are equal [1/1) (Again, this not necessarily the answer to the previous questions]. What is the new unlevered beta for the new Arios Software company? 0.95 1.55 1.1 1.325 Question 8 [2 paints] Assuming that the regression beta is correct, estimate the correct levered beta todivy, given the firm's current debt to equity matio. 0.75 1.4 10 1.82

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts