Question: Beth and Brian file a joint return in 2020. Use the following information to calculate their adjusted gross income. Beth and Brian are both high

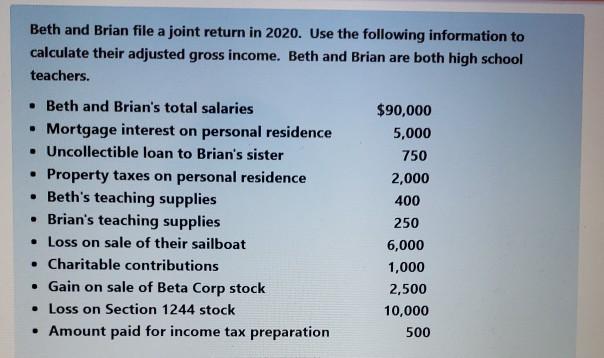

Beth and Brian file a joint return in 2020. Use the following information to calculate their adjusted gross income. Beth and Brian are both high school teachers. Beth and Brian's total salaries . Mortgage interest on personal residence . Uncollectible loan to Brian's sister Property taxes on personal residence Beth's teaching supplies Brian's teaching supplies Loss on sale of their sailboat Charitable contributions Gain on sale of Beta Corp stock Loss on Section 1244 stock Amount paid for income tax preparation $90,000 5,000 750 2,000 400 250 6,000 1,000 2,500 10,000 500 Beth and Brian file a joint return in 2020. Use the following information to calculate their adjusted gross income. Beth and Brian are both high school teachers. Beth and Brian's total salaries . Mortgage interest on personal residence . Uncollectible loan to Brian's sister Property taxes on personal residence Beth's teaching supplies Brian's teaching supplies Loss on sale of their sailboat Charitable contributions Gain on sale of Beta Corp stock Loss on Section 1244 stock Amount paid for income tax preparation $90,000 5,000 750 2,000 400 250 6,000 1,000 2,500 10,000 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts