Question: Bethany Cooke Products adopted the dollar-value LIFO method using 2018 as the base year for financial reporting purposes. It uses FIFO for its internal books.

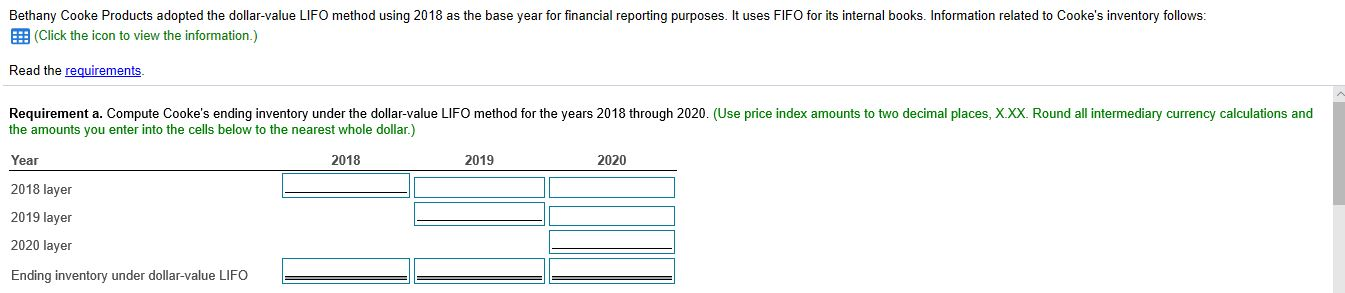

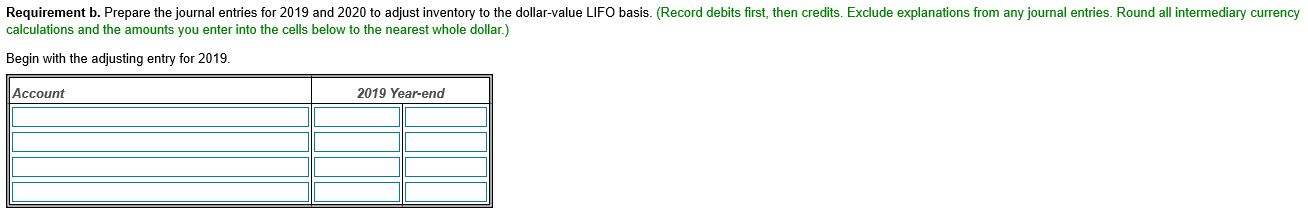

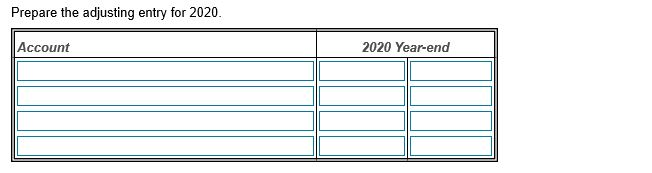

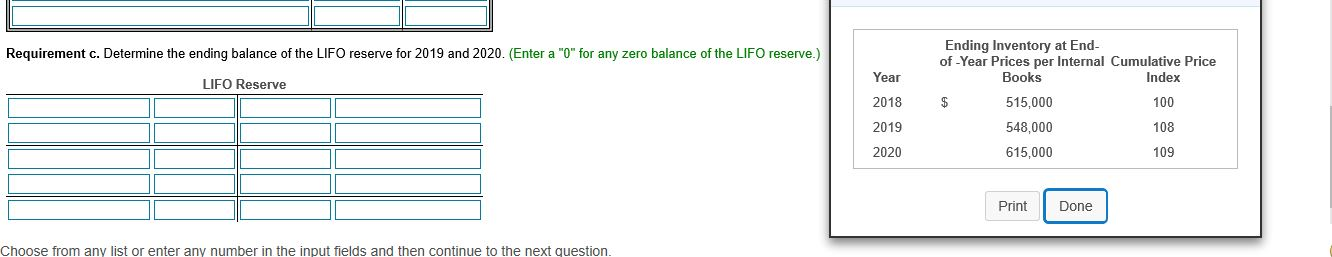

Bethany Cooke Products adopted the dollar-value LIFO method using 2018 as the base year for financial reporting purposes. It uses FIFO for its internal books. Information related to Cooke's inventory follows: (Click the icon to view the information.) Read the requirements. Requirement a. Compute Cooke's ending inventory under the dollar-value LIFO method for the years 2018 through 2020. (Use price index amounts to two decimal places, X.XX. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Year 2018 2019 2020 2018 layer 2019 layer 2020 layer Ending inventory under dollar-value LIFO Requirement b. Prepare the journal entries for 2019 and 2020 to adjust inventory to the dollar-value LIFO basis. (Record debits first, then credits. Exclude explanations from any journal entries. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Begin with the adjusting entry for 2019. Account 2019 Year-end Prepare the adjusting entry for 2020. Account 2020 Year-end Requirement c. Determine the ending balance of the LIFO reserve for 2019 and 2020. (Enter a "0" for any zero balance of the Year Ending Inventory at End- of-Year Prices per Internal Cumulative Price Books Index $ 515,000 100 LIFO Reserve 2018 2019 2020 548,000 615,000 108 109 Print Done Choose from any list or enter any number in the input fields and then continue to the next question. Bethany Cooke Products adopted the dollar-value LIFO method using 2018 as the base year for financial reporting purposes. It uses FIFO for its internal books. Information related to Cooke's inventory follows: (Click the icon to view the information.) Read the requirements. Requirement a. Compute Cooke's ending inventory under the dollar-value LIFO method for the years 2018 through 2020. (Use price index amounts to two decimal places, X.XX. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Year 2018 2019 2020 2018 layer 2019 layer 2020 layer Ending inventory under dollar-value LIFO Requirement b. Prepare the journal entries for 2019 and 2020 to adjust inventory to the dollar-value LIFO basis. (Record debits first, then credits. Exclude explanations from any journal entries. Round all intermediary currency calculations and the amounts you enter into the cells below to the nearest whole dollar.) Begin with the adjusting entry for 2019. Account 2019 Year-end Prepare the adjusting entry for 2020. Account 2020 Year-end Requirement c. Determine the ending balance of the LIFO reserve for 2019 and 2020. (Enter a "0" for any zero balance of the Year Ending Inventory at End- of-Year Prices per Internal Cumulative Price Books Index $ 515,000 100 LIFO Reserve 2018 2019 2020 548,000 615,000 108 109 Print Done Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts