Question: B)Evaluate your answer to a. Do you think that the project should be implementedwithout any concern? Explain your answer.c) Based on the information given above,

B)Evaluate your answer to a. Do you think that the project should be implementedwithout any concern? Explain your answer.c) Based on the information given above, analyze the combined effects of uncertainty inthe initial investment and net annual revenue on the AW value.d) Interpret your findings and write a short message to the investor about yourconcerns, if there is any.

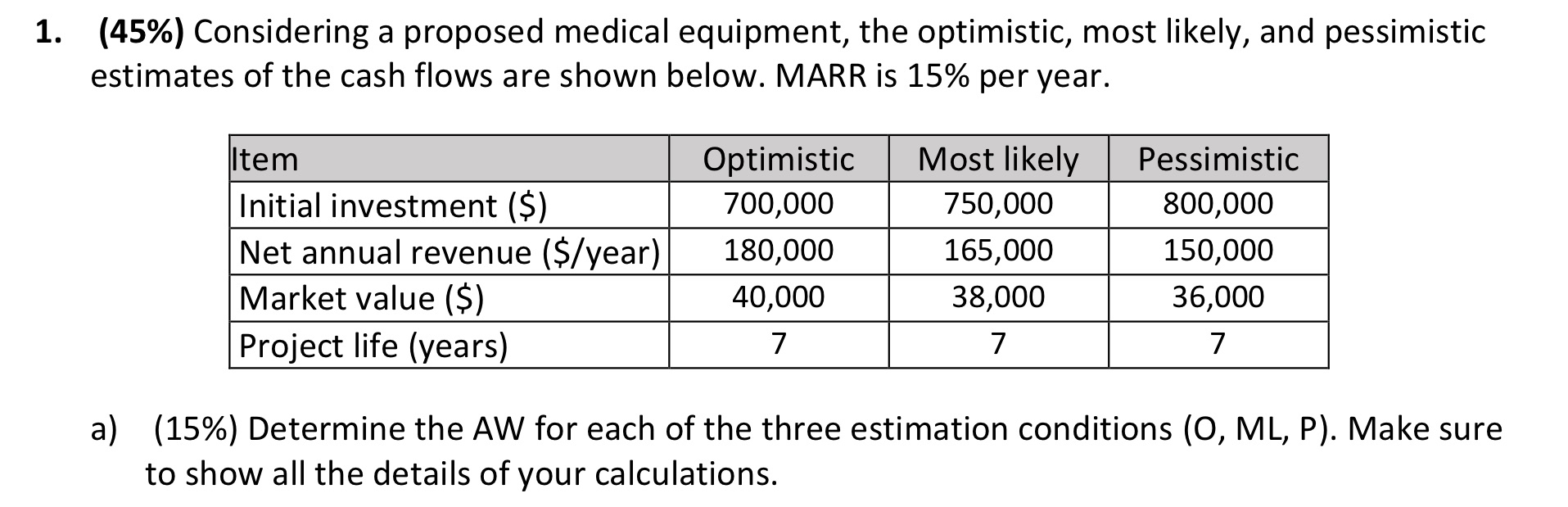

1. (45%) Considering a proposed medical equipment, the optimistic, most likely, and pessimistic estimates of the cash flows are shown below. MARR is 15% per year. Item Optimistic Most likely Pessimistic Initial investment ($) 700,000 750,000 800,000 Net annual revenue ($/year) 180,000 165,000 150,000 Market value ($) 40,000 38,000 36,000 Project life (years) 7 7 7 a) (15%) Determine the AW for each of the three estimation conditions (0, ML, P). Make sure to show all the details of your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts