Question: BFW2341_S1_2021_30247748 .XLSX File Edit View Insert Format Data Tools Help Last edit was 3 hours ago 90% 11 0.00123 Default (Ca. BIT ch A ...

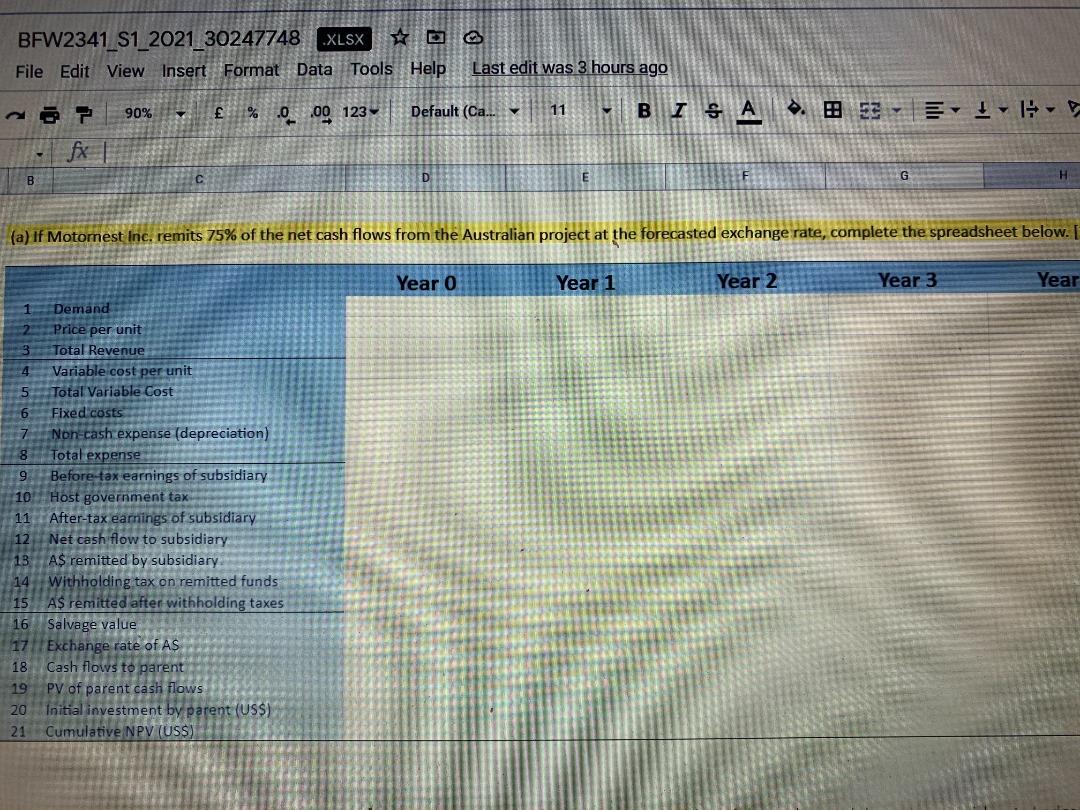

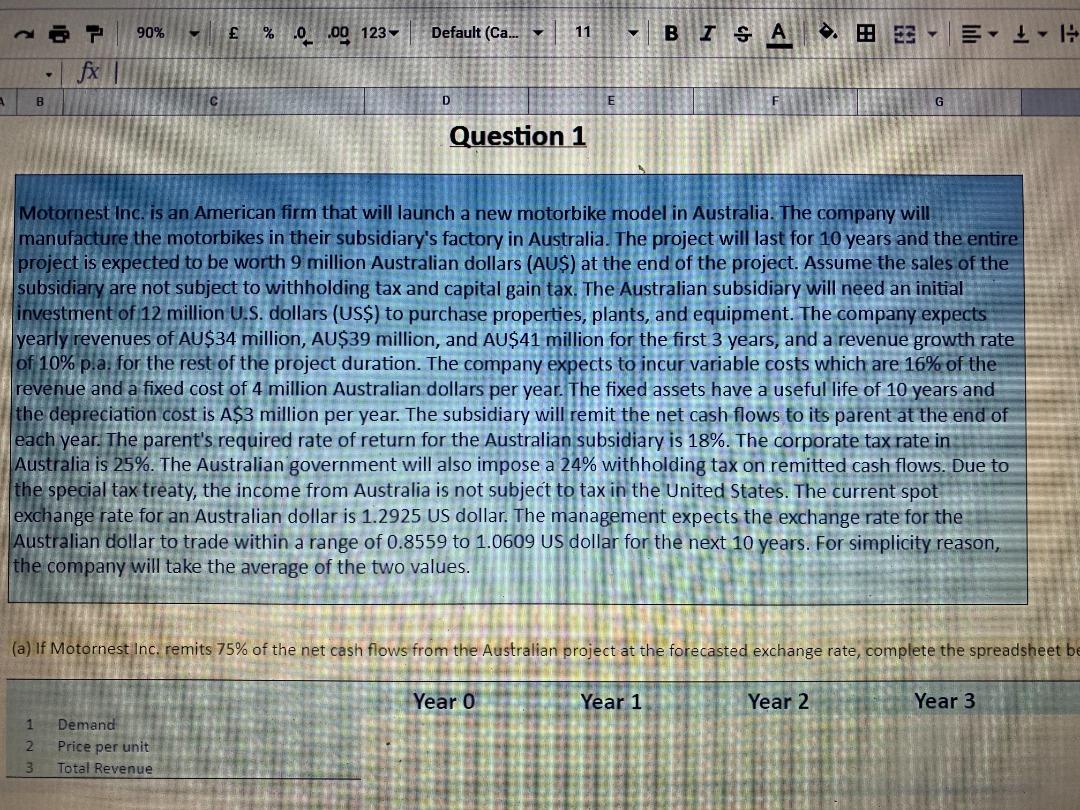

BFW2341_S1_2021_30247748 .XLSX File Edit View Insert Format Data Tools Help Last edit was 3 hours ago 90% 11 0.00123 Default (Ca. BIT ch A ... 53 ! D B G H (a) If Motorest Inc. remits 75% of the net cash flows from the Australian project at the forecasted exchange rate, complete the spreadsheet below. I Year o Year 1 Year 2 Year 3 Year 1 Demand Price per unit Total Revenue Variable cost per unit Total Variable Cost Fixed costs Nonecash expense (depreciation) Total expense 9 Before tax earnings of subsidiary 10 Host government tax 11 After-tax earnings of subsidiary 12 Net cash flow to subsidiary 13 A$ remitted by subsidiary 14 Withholding tax on remitted funds 15 A$ remitted after withholding taxes 16 Salvage value 17 Exchange rate of AS 18 Cash flows to parent 19 PV of parent cash flows 20 Initial investment by parent (US$) 21 Cumulative NPV (USS) 90% E % .0 .00 123 Default (Ca... 11 B IS .!! Es fx A D E G Question 1 Motornest Inc. is an American firm that will launch a new motorbike model in Australia. The company will manufacture the motorbikes in their subsidiary's factory in Australia. The project will last for 10 years and the entire project is expected to be worth 9 million Australian dollars (AUS) at the end of the project. Assume the sales of the subsidiary are not subject to withholding tax and capital gain tax. The Australian subsidiary will need an initial investment of 12 million U.S. dollars (US$) to purchase properties, plants, and equipment. The company expects yearly revenues of AU$34 million, AU$39 million, and AU$41 million for the first 3 years, and a revenue growth rate of 10% p.a. for the rest of the project duration. The company expects to incur variable costs which are 16% of the revenue and a fixed cost of 4 million Australian dollars per year. The fixed assets have a useful life of 10 years and the depreciation cost is A$3 million per year. The subsidiary will remit the net cash flows to its parent at the end of each year. The parent's required rate of return for the Australian subsidiary is 18%. The corporate tax rate in Australia is 25%. The Australian government will also impose a 24% withholding tax on remitted cash flows. Due to the special tax treaty, the income from Australia is not subject to tax in the United States. The current spot exchange rate for an Australian dollar is 1.2925 US dollar. The management expects the exchange rate for the Australian dollar to trade within a range of 0.8559 to 1.0609 US dollar for the next 10 years. For simplicity reason, the company will take the average of the two values. (a) If Motornest Inc. remits 75% of the net cash flows from the Australian project at the forecasted exchange rate, complete the spreadsheet be Year 0 Year 1 Year 2 Year 3 1 2 3 Demand Price per unit Total Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts