Question: BHELL has to decide whether or not to drill for oil in a new offshore site located in South China Sea, close to the

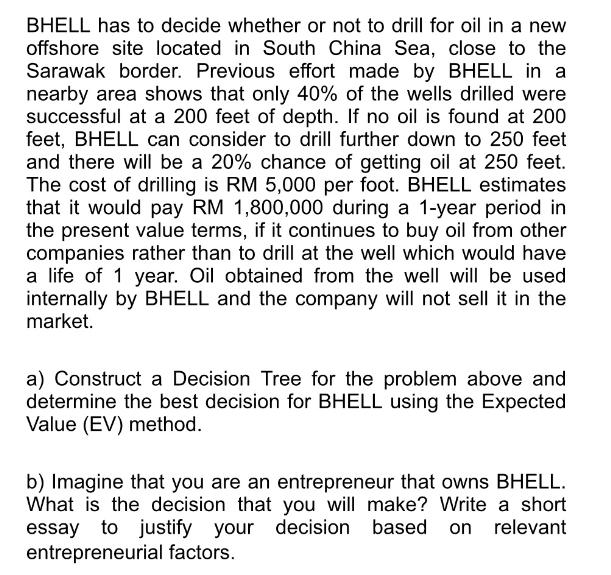

BHELL has to decide whether or not to drill for oil in a new offshore site located in South China Sea, close to the Sarawak border. Previous effort made by BHELL in a nearby area shows that only 40% of the wells drilled were successful at a 200 feet of depth. If no oil is found at 200 feet, BHELL can consider to drill further down to 250 feet and there will be a 20% chance of getting oil at 250 feet. The cost of drilling is RM 5,000 per foot. BHELL estimates that it would pay RM 1,800,000 during a 1-year period in the present value terms, if it continues to buy oil from other companies rather than to drill at the well which would have a life of 1 year. Oil obtained from the well will be used internally by BHELL and the company will not sell it in the market. a) Construct a Decision Tree for the problem above and determine the best decision for BHELL using the Expected Value (EV) method. b) Imagine that you are an entrepreneur that owns BHELL. What is the decision that you will make? Write a short essay to justify your decision based on relevant entrepreneurial factors.

Step by Step Solution

3.36 Rating (143 Votes )

There are 3 Steps involved in it

Answer A Decision Tree and Expected Value EV Calculation Lets construct a decision tree to visualize the problem Oil 40 RM 5000000 Start 200 ft 60 No ... View full answer

Get step-by-step solutions from verified subject matter experts