Question: Bicester Electronics is an established Electronics product SME. Last year its summary Profit and Loss is as shown in Table 2.1 and its Balance

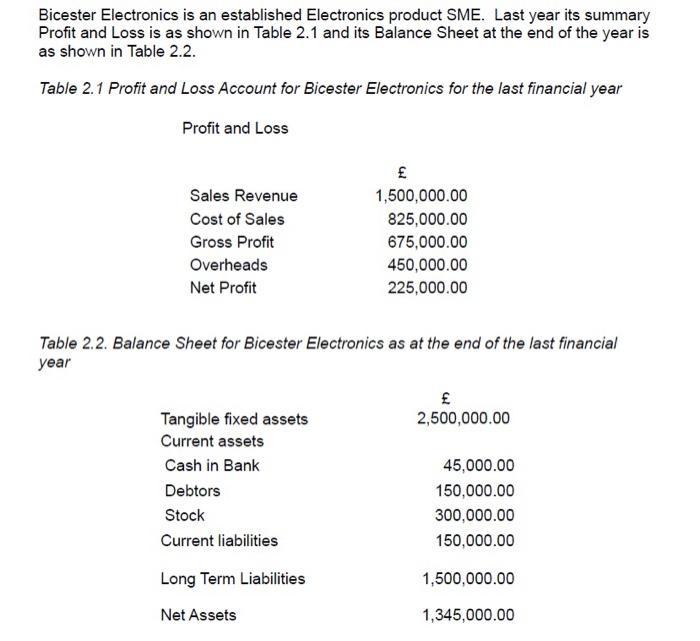

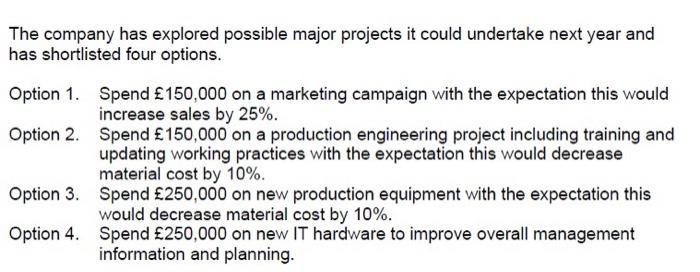

Bicester Electronics is an established Electronics product SME. Last year its summary Profit and Loss is as shown in Table 2.1 and its Balance Sheet at the end of the year is as shown in Table 2.2. Table 2.1 Profit and Loss Account for Bicester Electronics for the last financial year Profit and Loss Sales Revenue 1,500,000.00 Cost of Sales 825,000.00 Gross Profit 675,000.00 Overheads 450,000.00 Net Profit 225,000.00 Table 2.2. Balance Sheet for Bicester Electronics as at the end of the last financial year Tangible fixed assets 2,500,000.00 Current assets Cash in Bank 45,000.00 Debtors 150,000.00 Stock 300,000.00 Current liabilities 150,000.00 Long Term Liabilities 1,500,000.00 Net Assets 1,345,000.00 The company has explored possible major projects it could undertake next year and has shortlisted four options. Option 1. Spend 150,000 on a marketing campaign with the expectation this would increase sales by 25%. Option 2. Spend 150,000 on a production engineering project including training and updating working practices with the expectation this would decrease material cost by 10%. Option 3. Spend 250,000 on new production equipment with the expectation this would decrease material cost by 10%. Option 4. Spend 250,000 on new IT hardware to improve overall management information and planning. You can assume that the company expects the amount of cash the company will have in the bank at the end of next year irrespective of which project they adopt will remain at 45,000. You can also assume that: the debtor amount is always 10% of sales revenue; stock value is always 20% of sales revenue and the creditor amount is always 10% of sales revenue. All the projects will be funded through long term debt. (a) What was the ROS and ROCE for last year? [2 Marks] [16 Marks] (b) What effect will each project have on ROS and ROCE? (c) Which project would you recommend they adopt and why? [7 Marks]

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

a Last year analytics of ROS and ROCE i ROS Return on sales Operating incomeRevenue 6750001500000 45 Since there are no operating expenses given speci... View full answer

Get step-by-step solutions from verified subject matter experts