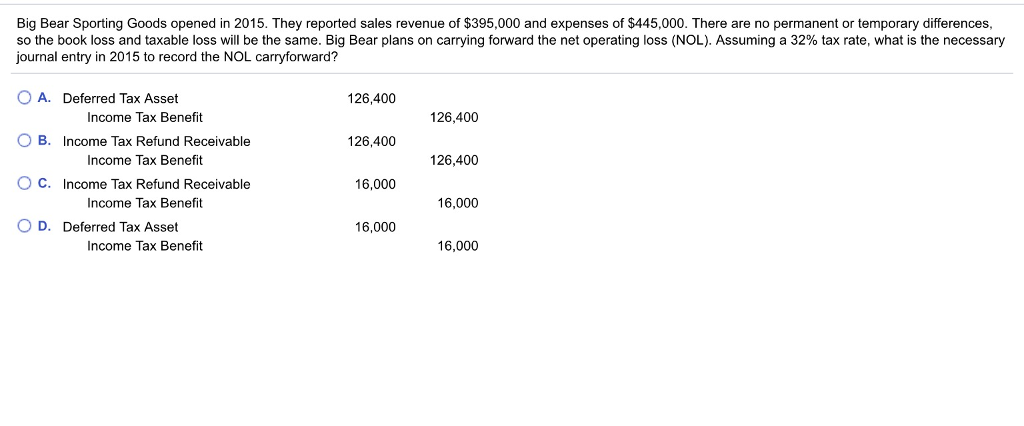

Question: Big Bear Sporting Goods opened in 2015. They reported sales revenue of $395,000 and expenses of $445,000. There are no permanent or temporary differences, so

Big Bear Sporting Goods opened in 2015. They reported sales revenue of $395,000 and expenses of $445,000. There are no permanent or temporary differences, so the book loss and taxable loss will be the same. Big Bear plans on carrying forward the net operating loss (NOL). Assuming a 32% tax rate, what is the necessary journal entry in 2015 to record the NOL carryforward? O A. Deferred Tax Asset 126,400 Income Tax Benefit 126,400 126,400 O B. ncome Tax Refund Receivable Income Tax Benefit 126,400 O C. ncome Tax Refund Receivable 16,000 Income Tax Benefit 16,000 o D. Deferred Tax Asse 16,000 16,000 Income Tax Benefit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts