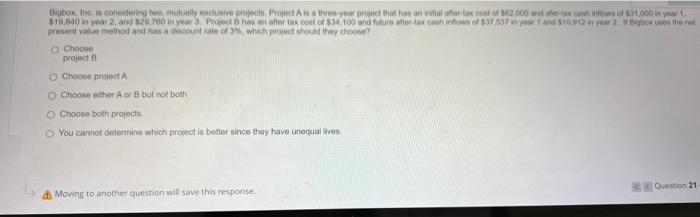

Question: big box inc is considering two, mutually exclusive projects. project a is a three year project that has an initial tax cost of 62,000 and

Ghoose projoct A Choone project A Choose either A ar B tuit not boeth Choose both propoct You cannot dotermine which project is better since thay have unecual mes: (1) Moving to another question will save this response. Quesson 21 Choorse project 3 Choose propect A Choose exther A or B but hot both Choose both projects You cannot delermine which project is better since they have unequal ives. ab Moving to another question will save this response. Countion 21 in 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts