Question: Big Corp is planning to fully acquire Small Corp. Big Corp currently has 10 million shares outstanding with a share price of $50 and

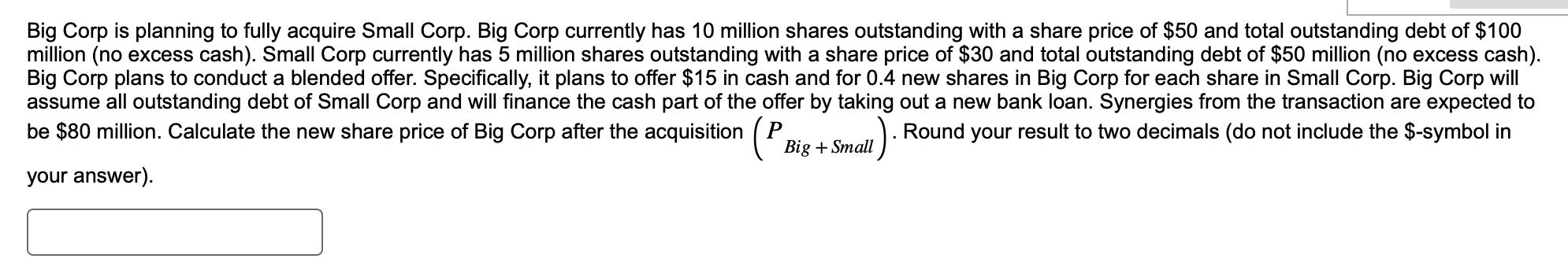

Big Corp is planning to fully acquire Small Corp. Big Corp currently has 10 million shares outstanding with a share price of $50 and total outstanding debt of $100 million (no excess cash). Small Corp currently has 5 million shares outstanding with a share price of $30 and total outstanding debt of $50 million (no excess cash). Big Corp plans to conduct a blended offer. Specifically, it plans to offer $15 in cash and for 0.4 new shares in Big Corp for each share in Small Corp. Big Corp will assume all outstanding debt of Small Corp and will finance the cash part of the offer by taking out a new bank loan. Synergies from the transaction are expected to Round your result to two decimals (do not include the $-symbol in be $80 million. Calculate the new share price of Big Corp after the acquisition ( P your answer). Big + Small

Step by Step Solution

There are 3 Steps involved in it

Solution To calculate the new share price of Big Corp after the acquisition we can follow these step... View full answer

Get step-by-step solutions from verified subject matter experts