Bigbee Company currently has no debt; it is 100% equity financed. With its current capital structure, the

Fantastic news! We've Found the answer you've been seeking!

Question:

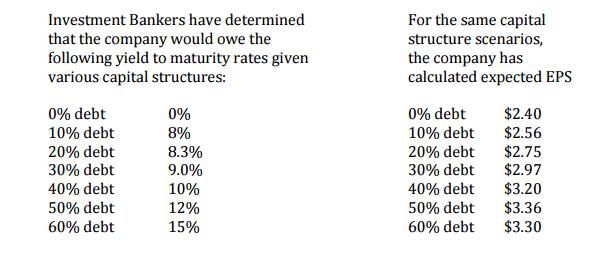

Bigbee Company currently has no debt; it is 100% equity financed. With its current capital structure, the stock’s beta is 1.5. The company is looking to take on some debt to buy back some stock, but management is unsure of how much debt to issue. You have been asked to calculate the optimal capital structure.

The company is experiencing zero growth, and that will continue for the foreseeable future; therefore, there is no immediate need to retain any earnings. All of its earnings are given out in dividends. The company’s tax rat is 40%. The risk free rate is 6% and the market risk premium is 4%.

Related Book For

Introduction to Corporate Finance What Companies Do

ISBN: 978-1111222284

3rd edition

Authors: John Graham, Scott Smart

Posted Date: