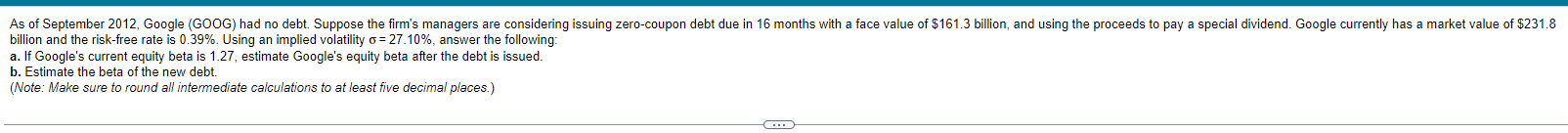

Question: billion and the risk-free rate is 0.39%. Using an implied volatility =27.10%, answer the following: a. If Google's current equity beta is 1.27, estimate Google's

billion and the risk-free rate is 0.39%. Using an implied volatility =27.10%, answer the following: a. If Google's current equity beta is 1.27, estimate Google's equity beta after the debt is issued. b. Estimate the beta of the new debt. (Note: Make sure to round all intermediate calculations to at least five decimal places.) billion and the risk-free rate is 0.39%. Using an implied volatility =27.10%, answer the following: a. If Google's current equity beta is 1.27, estimate Google's equity beta after the debt is issued. b. Estimate the beta of the new debt. (Note: Make sure to round all intermediate calculations to at least five decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts