Question: Binomial Options Problem-02a: Consider ABC stock priced at $100 can go up of down 20% per period. Assume the risk free rate is 4% and

Binomial Options

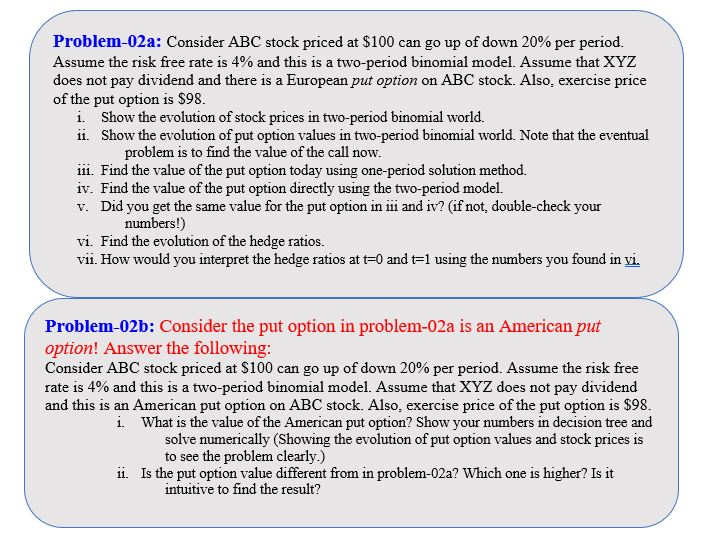

Problem-02a: Consider ABC stock priced at $100 can go up of down 20% per period. Assume the risk free rate is 4% and this is a two-period binomial model. Assume that XYZ does not pay dividend and there is a European put option on ABC stock. Also, exercise price of the put option is S98 i. Show the evolution of stock prices in two-period binomial world. ii. Show the evolution of put option values in two-period binomial world. Note that the eventual problem is to find the value of the call now 111. Find the value of the put option today using one-period solution method. iv. Find the value of the put option directly using the two-period model. v. Did you get the same value for the put option in ii and iv? (if not, double-check your numbers!) vi. Find the evolution of the hedge ratios vii. How would you interpret the hedge ratios at t-0 and t-1 using the numbers you found in yi. Problem-02b: Consider the put option in problem-02a is an American put option! Answer the following Consider ABC stock priced at $100 can go up of down 20% per period. Assume the risk free rate is 4% and this is a two-period binomial model. Assume that XYZ does not pay dividend and this is an American put option on ABC stock. Also, exercise price of the put option is $98 i. What is the value of the American put option? Show your numbers in decision tree and solve numerically (Showing the evolution of put option values and stock prices is to see the problem clearly.) ii. Is the put option value different from in problem-02a? Which one is higher? Is it intuitive to find the result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts