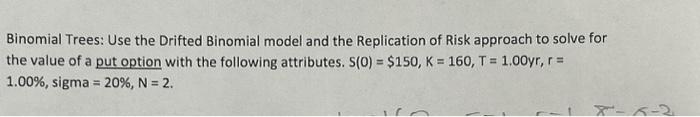

Question: Binomial Trees: Use the Drifted Binomial model and the Replication of Risk approach to solve for the value of a put option with the following

Binomial Trees: Use the Drifted Binomial model and the Replication of Risk approach to solve for the value of a put option with the following attributes. S(0)=$150,K=160,T=1.00yr,r= 1.00%, sigma =20%,N=2. Binomial Trees: Use the Drifted Binomial model and the Replication of Risk approach to solve for the value of a put option with the following attributes. S(0)=$150,K=160,T=1.00yr,r= 1.00%, sigma =20%,N=2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts