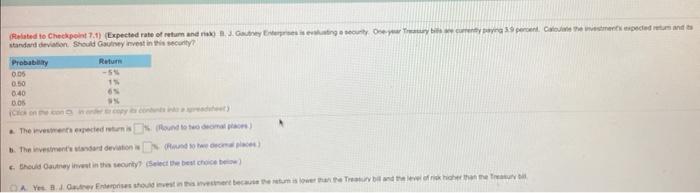

Question: BJ Gautney Enterprises is evaluting a security. One year treasury bills are currently paying 3.9 percent. Calculate the investments expected return and its standard deviation.

Related to Checkpoint 7,0) Expected rate of retums. Gamyboy Dywca 35 percent Commentereded it and a standard deviation Should Gay invest in this security Probably Return 005 0.50 0:40 DOS OS The wees expected Round to conto The investment's adort van het thuid autre investin the security Select the best choice DAY 3 Episode his because mishandelier than me

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts